S&P 500 Price Analysis – December 27

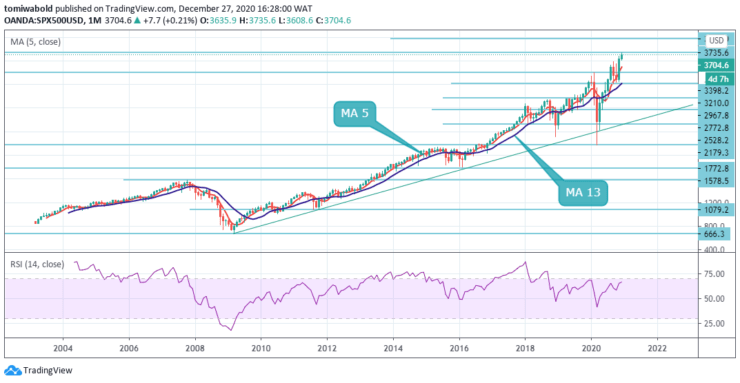

The S&P 500 may increase by about 15% to 20% in 2021, after gaining nearly 15% in 2020. The index had hit a low of 2179.2 during March market carnage and has rebounded to print yearly highs of 3735.6 level. The recovery from lows has been swifter and more robust than most participants had anticipated.

Key Levels

Resistance Levels: 4016, 3970, 3840

Support Levels: 3588, 3398, 3210

S&P 500 is back to all-time highs at 3735.6, which we see in trading bullish of a higher beyond the monthly moving average 5. The S&P 500 may be in process of putting in the highs for the 2021 year towards 4000.00.

This monthly chart shows several years of S&P consistent upside traction from its 2010 lows around 666.3 level. S&P 500 suggests the rally from the October low of 3210 levels is unfolding as a bullish structure. It is currently in progress and the continuation pattern is unfolding as another impulse in lesser intensity.

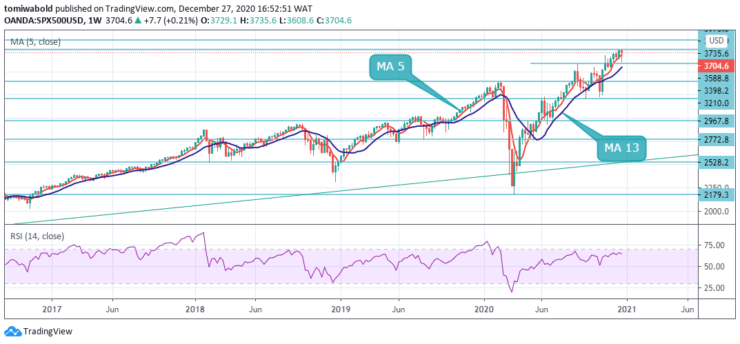

As seen on the weekly chart up from lows at 2179.3, it ended at 3588.8, and before another wave and the dips ended at 3210.0. The index then resumed higher to 3735.6 and is expected to end soon.

We’ll be expecting the index to then pullback before turning higher for the 2021 bull run to 4000.

Afterward, expect a bigger pullback to correct the cycle from November low before the rally resumes. The potential target higher is a minimum of 100% – 123.6% from October lows which comes at 3210 – 4016 levels.

Conclusion

The S&P 500 market consolidates following its successful defense of the 3210 low from earlier October. Although the broader trend stays seen higher, with momentum not confirming the new highs in addition to further signs of exhaustion, the bias remains to look for further consolidation, before this core bull trend eventually resuming in 2021.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.