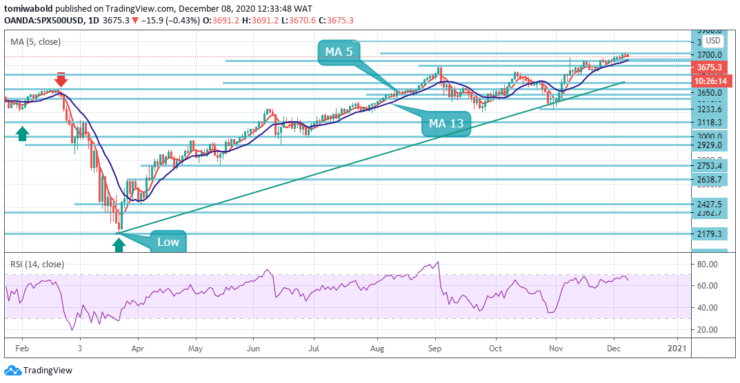

S&P 500 Price Analysis – December 8

S&P 500 index declined towards a level at 3676, down 0.30%, during the session. The index extends the prior day’s pullback from the historic high of 3706 levels. S&P 500 is modestly lower and seems to be struggling to pare its losses. The uncertainty over the US stimulus has earlier soured market sentiment, talks on the US-China rift weighed on the risk-tone.

Key Levels

Resistance Levels: 3900, 3800, 3700

Support Levels: 3650, 3522, 3450

As observed on the daily time frame, the middle level 3650 is required as support, then the next sublevels are 3638 zones, once the 3650 level becomes the tested support then the market may ascend once higher to 3700 levels, with a minor level of resistance at 3800.

Above in due course, we should see what may look to be a tougher test of a cluster of forecast zones around the 3765/85 band. Although in a larger context, we continue to eventually look for the measured objective at 3900 levels while below can see a pullback to 3650 regions, but with fresh buyers expected here. We maintain our tactical bullish bias whilst above the 3522 levels.

S&P 500 index pulled below the all-time high of 3706 levels and slightly under the short-term moving average 5 and 13 in the 4-hour chart. The relative strength index is holding beneath its midline while the price remains in the positive region. If the bears take control, immediate support could come from horizontal support at the 3650 levels.

On the flip side, an upside extension could take the index towards the all-time high of 3706 levels and then towards the 3800 resistance. All in all, the S&P 500 index maintains an upward move in the near term despite the ongoing correction.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.