S&P 500 Price Analysis – November 24

S&P 500 increases with over 32 points, or 0.73% intraday, ahead of Tuesday’s American open. A higher turn by S&P 500 moves to recover past the level at 3600 and may be taken as an upside signal by investors as vaccine hopes favor buyers.

Key Levels

Resistance Levels: 3700, 3650, 3625

Support Levels: 3550, 3477, 3400

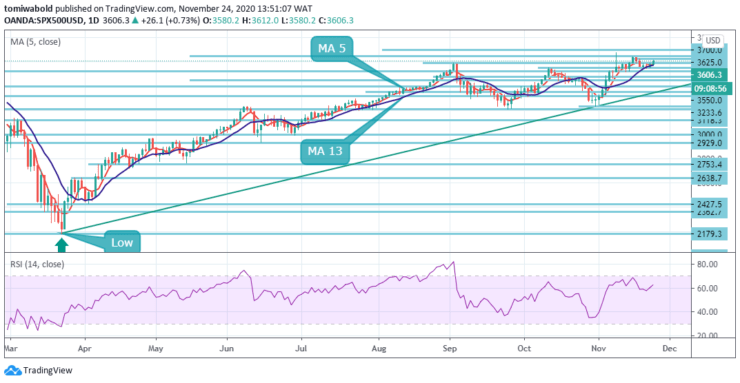

On the daily chart, the S&P 500 is ideally holding steady support around the 5 and 13 moving averages at 3580 for a possible break above 3650 to complete the bullish pennant pattern to strengthen the existing and larger bullish structure.

Conversely, if the bulls gain the upper hand and push the S&P 500 higher, resistance at the psychological 3650 will be important to limit gains. If bears gain the upper hand and direct the index below recent lows near 3580, the door will open to retest the 3550-3522 area.

In the 4 hours chart, the first resistance remains at 3650, followed by short-term downtrend support at 3588. Above 3650 is required to clear the way for retesting the current high at 3674. Short term technical indicators are currently endorsing the ranging outlook as the RSI is heading away from the overbought threshold.

Then there was trending resistance from the previous week, now at 3625, with new sellers expected from here at the moment. The preferred bias is long positions above 3550 with targets at 3650 and 3700 thereafter. In an alternate scenario below 3550, traders may look for further declines with 3522 and 3477 as targets.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.