S&P 500 Price Analysis – November 10

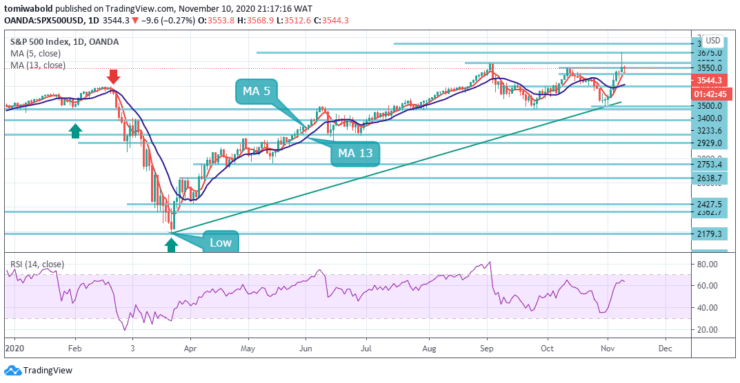

S&P 500 pullback from the all-time high continues lower as it retreats beneath the 3350 levels during early Tuesday. The COVID-19 vaccine-induced optimism, mainly propelled by headlines from Pfizer-BioNTech research boosted the financial markets but later weakened.

Key Levels

Resistance Levels: 3750, 3600, 3550

Support Levels: 3500, 3400, 3210

The S&P 500 pullbacks ideally hold support at 3500 marks around the moving average 5 to maintain thoughts of a bullish rebound and strength back to the 3675 levels. The next immediate support is seen at 3400 levels, below which can see a fall to 3233 levels.

After the prior day’s rally in the S&P 500 which coincided with a large move to the 3675 levels and later retreated to start a consolidation beneath the 3350 levels. The index upside records the best move in its prior 7 months in 2020. The upside break of the 3350 levels will confirm the resumption of the long term uptrend.

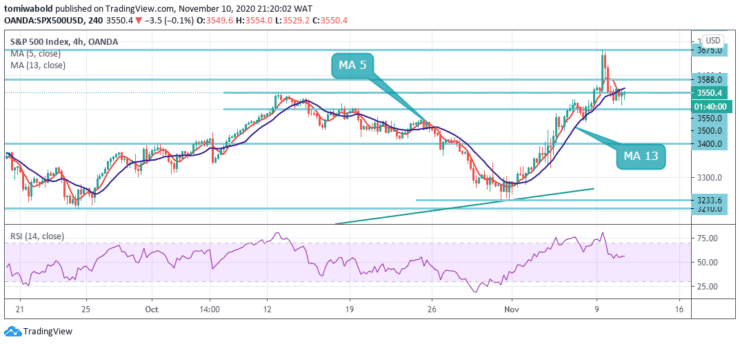

A similar picture is seen in 4 hours S&P 500 as consolidation from 3588 levels could have completed with three waves to 3233 levels. Further upside breakout could be seen soon. The firm break of the 3588 levels will validate short term bullish bias. In the alternative scenario beneath here the further downside may gain traction towards 3440 & 3400 levels.

On the flip side, a rising bearish momentum and south heading Relative Strength Index warn of further weakness which would bring bears fully in play on a firm break of 3500 pivots. The anticipated scenario is positioned beyond 3500 levels with targets at 3550 and 3588 levels extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.