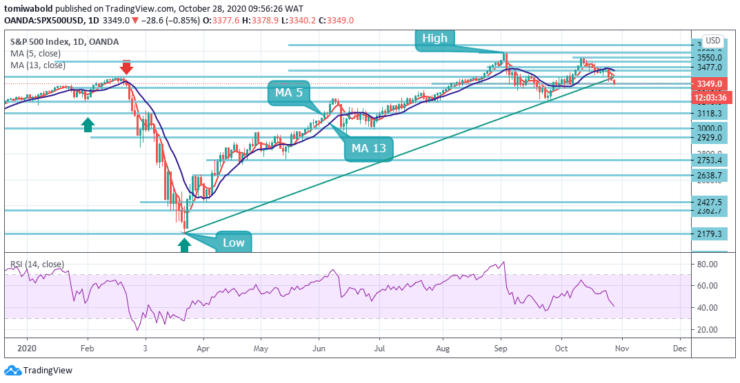

S&P 500 Price Analysis – October 28

S&P 500 declines under 3350 level while flashing red on renewed coronavirus concerns and fading prospects of additional fiscal stimulus deal. At press time, the S&P 500 futures are down over 0.85% at the 3349 levels. S&P 500 has seen a sharp sell-off and a daily close beneath the ascending trendline may reassert a sideways.

Key Levels

Resistance Levels: 3522, 3450, 3400

Support Levels: 3318, 3210, 3000

S&P 500 extended its losses from the prior session beneath the 3350 levels while searching for support. On the downside, the bears will contend with the key support at the horizontal level of 3318. An intermediate corrective bounce from the 3318 levels cannot be ruled out before the fall extends to 3210 levels in September lows.

A break higher past the 3350 levels can trigger and accelerate the recovery. 3400 level will be a good resistance-turned-turned that can limit the downside if flipped. Also, a further break below the 3318 levels will trigger a much deeper fall to 3210 levels and even 3000 levels over the long to medium-term.

In the shorter time frame, the S&P 500 stays pressured by the 4 hours moving average of 5 with eyes on the 3318 levels. Traders that are bullish towards the S&P 500 pair may consider buying any technical pullbacks towards the 3400 level.

Multiple prices close beneath the technically important 3350 levels will confirm the start of a new bearish short-term trend. Near-term resistance is seen at the 3400 levels, then 3450 levels. Above 3477 levels is needed to reassert a positive tone again, with resistance then at 3522 levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.