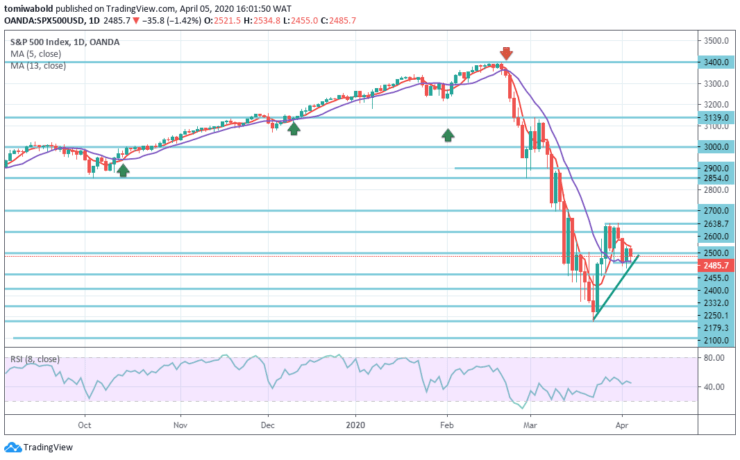

S&P 500 Price Analysis – April 5

In the first quarter of the financial crisis, the S&P 500 reported its worst performance, as recorded cases of coronavirus now amount to over a million globally. The S&P 500 began the new quarter after rising by 17.9% relative to its low in the last seven trading days, with a marginal 4.4% fall.

Key Levels

Resistance Levels: 3139.0, 2900, 2600

Support levels: 2400, 2179.3, 2000

S&P 500 Long term Trend: Bearish

From a technical point of view, despite the latest rebound, nevertheless, negative risks remain unchanged. Staring at the S&P 500, especially with the current upside down, it barely stands above a long-term supporting trendline.

The S&P 500 is fragile under the resistance levels of 2500/2600, as the bullish movement seems to have eased at the end of March, although sellers may return in force to the market to push it down to the levels of 2332.0 and 2250.1 with resistance expected to be near the level of 2600 and 2700.

S&P 500 Short term Trend: Ranging

The market inevitably attempts to rebound, and it seems, at a second glance, the price is again running out of upside momentum. As per the RSI, an upswing is probable as the market is hovering past oversold region.

The path to the supportive zone of 2332.0 -2179.3 levels may open if the index falls significantly beneath the ascending trendline. The next major hurdle between 2100 and 2000 levels may develop from this floor.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.