S&P 500 Price Analysis – April 28

The S&P 500 is up on the optimism that coronavirus lockdown will soon end, as the Economy at least partially re-open. Consequently, at the time of writing, we see the S&P 500 rise by 1.50 percent from a low of 2858.2 to a high of 2915.0 levels.

Key Levels

Resistance Levels: 3139.0, 3000, 2900

Support levels: 2800, 2753, 2638

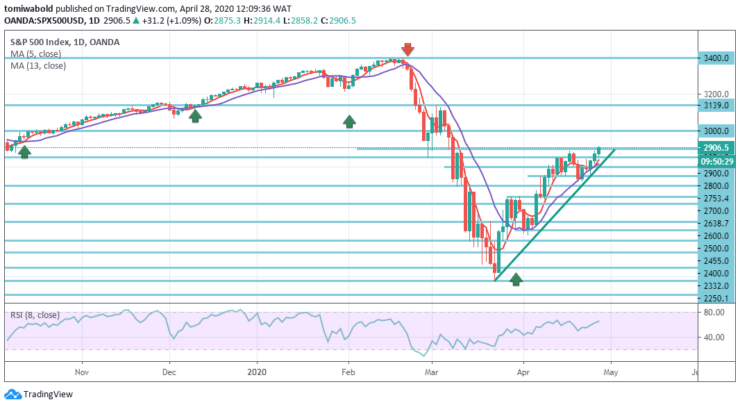

S&P 500 Long term Trend: Ranging

The S&P 500, though holding above the 5 and 13 moving averages on the daily chart, trades with a moderate advance past the 2854.0 resistance turned support level. A daily closing beyond the aforementioned level may trigger further buying activity and push the market to the high-level swing past 2900 level and eventually to the high round figure at the 3000 levels.

On the other hand, support may emerge near 2854 level, flipping support, and 2800 levels in case of a pullback. The S&P 500 rally from 2020 lows nevertheless remains intact as the 2900 level of resistance attracts buyers.

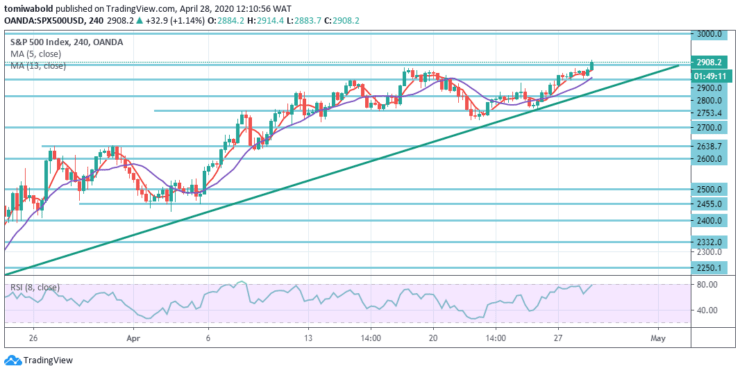

S&P 500 Short term Trend: Bullish

With the risk-on mood showing the dominance, the S&P 500 increased the gains of the prior day into the European session on Tuesday to roughly 2881.2 level during the initial Asian session.

The S&P 500 may continue bullish past the level of 2900.0 with projections in continuation at 3000.00 levels & above. The ideal scenario for sellers, on the opposite, is price beneath 2854.0 level for further downside with target levels of 2753.0 and 2700.0.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.