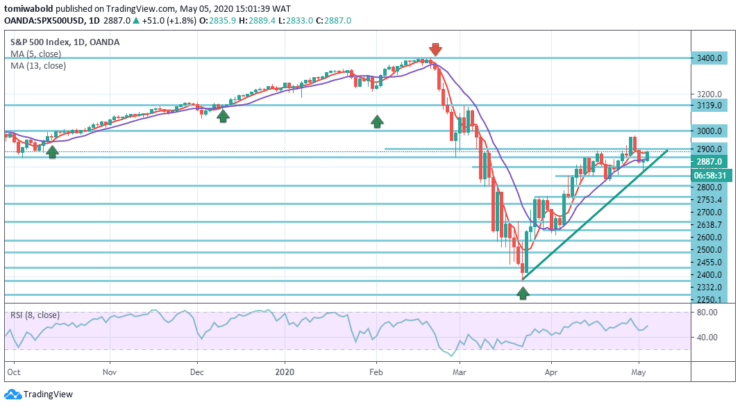

S&P 500 Price Analysis – May 5

Yet again, the S&P 500 has managed to hold on to a closing rebound from its rising 13-day average, presently seen at 2880 levels. S&P 500 seems to be seeking its initial significant break following a 35 percent recovery from the lows. The World Health Organization (WHO) stays away from endorsing China’s US suspicions on coronavirus as this seems to carry the center.

Key Levels

Resistance Levels: 3139.0, 3000, 2900

Support levels: 2800, 2753, 2638

S&P 500 Long term Trend: Ranging

S&P 500 has already crossed the level of resistance at 2854. We foresee continued rally testing the next main area at level 2900 until we see a few reactions. The potential trend is the turnaround from level 2854 could form a long entry on anticipating the continuation of an upward trend to test level 2900. Otherwise, rejection from the level at 2900 could be an initial entry.

A closing beneath previously mentioned moving average of 13 at level 2839 is required to add support to this outlook with support seen also at level 2800, then level 2753.4 – the 23.6 percent retraction of the entire March/April rebound. However, beneath 2753.4 level stays at the later part of the day to indicate a more pivotal point.

S&P 500 Short term Trend: Bullish

In the near term, we foresee the potential for a rebound from the price gap seen on Friday, seen originating at 2800 level upwards and extending to 2900 level, to test resistance. Any such reversal may be a welcome break later in the week, and a required basis for higher prices.

Switching to the short-term indicators, advances are supported by the RSI and the moving averages on the 4-hour chart which is forming a slope. A sustainable, stable rebound may require market-wide activity and not just a bullish outlook. The chance of yet another bearish turn stays high.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.