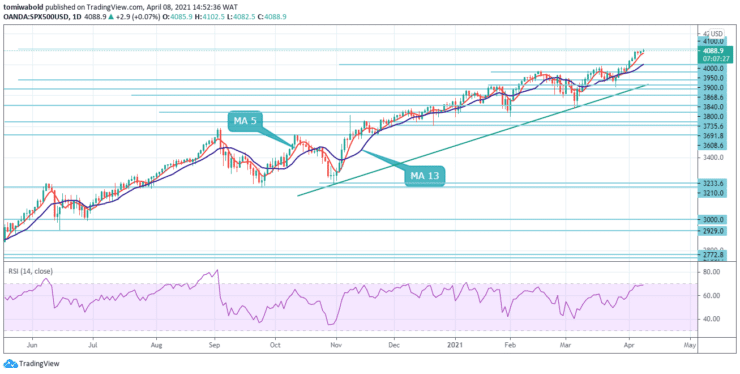

S&P 500 Price Analysis – April 8

S&P 500 renewed its year high by rising above 4100 at the time of this post. The index is consolidating under a new record high of 4102.5, posted after a 0.12% rally on Thursday, sparked by positive market sentiment. The global economy jumped as optimism about rapid growth surpassed geopolitical risks.

Key Levels

Resistance Levels: 4300, 4200 4100

Support Levels: 4000, 3900, 3800

The S&P 500 has gained ground after a month of strong negative sessions, with the RSI indicator turning up and establishing a bullish crossover towards its overbought territory. Currently, the price found resistance at the horizontal line at 4100 levels and the price is moving is still trending to flip the resistance into support.

A close beyond 4100 remains in the picture, indicating the level as possible solid support. Meanwhile, the 4000 levels are likely to act as support on the downside. Trading above this region will help to hold the emphasis to the upside, towards the 4200 levels. If the index fails to close the day above the 4100, which is currently seen as a fresh zone for the bulls, the level at 4000 could support the buying pressure to remain intact.

On the four-hour time frame, price action has broken through the 4100 resistance line but eased to 4089 near-term lows. A break beneath the 4-hour MA 13 at the bottom invalidates the bullish run, while sustained trading above the 4100 top confirms the uptrend. On the downside, if the S&P 500 succeeds to break lower through the MA 5 and MA 13 confluence zone, it can fall to the 4000 levels.

Otherwise, if sellers fail to drive the S&P 500 below to the key 4000 levels and the 4-hour moving average 5 and 13 it may increase the risk of a move higher towards the 4200 levels. In the event selling interest persists, the key support region of 3950 and the 3900 levels, which overlaps with the ascending trendline from March could halt the decline.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.