S&P 500 Price Analysis – May 12

While United States President Donald Trump’s stern position toward China is impacting on the market’s risk-on mood, S&P 500 grapples with bears while wavering at negative 0.30 percent to 2901 level during Tuesday’s early European session. When S&P 500 was being published, it’s drifting while increasing in value at the 2924 level.

Key Levels

Resistance Levels: 3139.0, 3000, 2953.4

Support levels: 2854, 2800, 2753

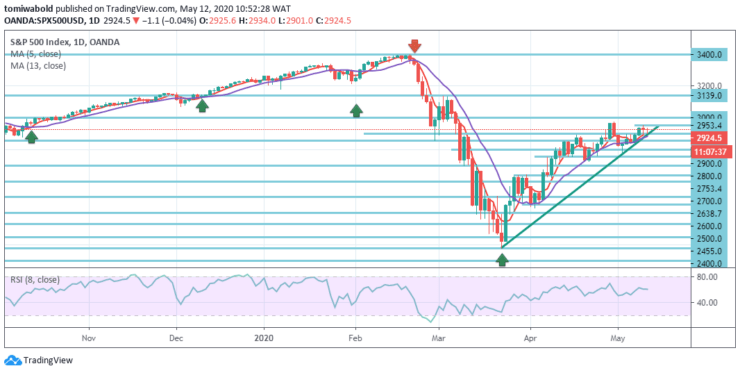

S&P 500 Long term Trend: Ranging

The S&P 500 proceeds to trade on the second day of the week with a retracement down to the level of 2901 eliminating much of the gains achieved in previous sessions on an intraday basis. Bears may attempt to close beneath level daily of 2900 to breach support levels.

The market is also in a deep bullish turnaround, besides that, yet it appears to be seen just how far the bearish turn may go. Initially, immediate support is shown at level 2900, then level 2854.0, beyond which the imminent risk may be retained higher. The S&P 500 might see pressure expanding to 3000-level resistance beyond 2953.4 level. We are possibly looking for all this to limit and inevitably to develop a top.

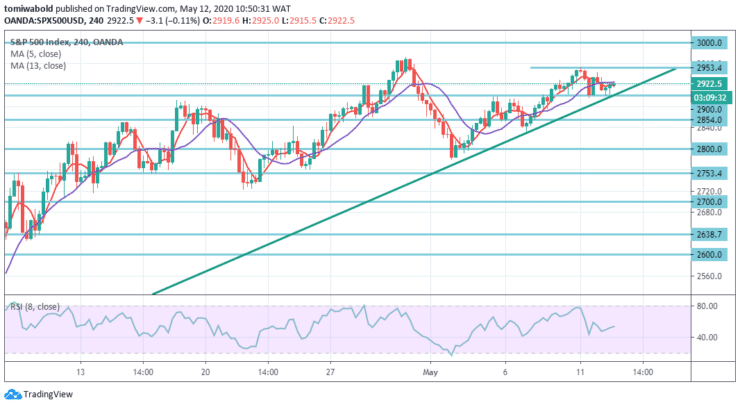

S&P 500 Short term Trend: Bullish

On the 4-hour time frame, the index fails to surpass the level of 2953.4, that is to say, the optimistic tone of the rising trendline and the short-term oscillators further back a forward outlook. The moving average of 5 and 13 is in the positive section and holding it up, while the RSI creeps higher than its neutral 50 levels.

If buyers continue to push over the near-term barrier of level 2953.4, strong resistance may emerge from the nearby high level of 3000 and that combined with an overhead horizontal level around the level of 3139 as seen on the daily chart. If these barriers are conquered, the price may aim for the moon.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.