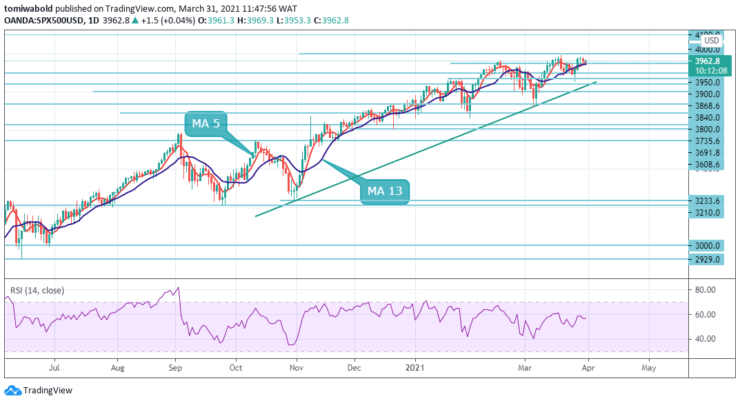

S&P 500 Price Analysis – March 31

The S&P 500 index rose to weekly highs of 3,983.4 on Monday, but the upside bias has dwindled ahead of the 4000 key barriers in the current session. The US 10-year Treasury yield stays firm around the highest since January 2020. Dollar and US yields will continue to rise due to strong economic results.

Key Levels

Resistance Levels: 4100, 4050, 4000

Support Levels: 3950, 3900, 3840

As seen on the daily, the uptrend may be expected to falter and stay beneath the 4000 levels, while the market is trading above the daily MA 5 and 13, consolidating further into the following session, which will be followed by re-attempting the resistance level at 4000.

The technical indicators are currently endorsing the ranging outlook as the RSI is heading toward its midline reading at 50 while the price turned lower after retracement from the weekly high at 3,983.4 marks. The moving averages 5 and 13 maintain their position and may move slightly horizontally in the medium-term outlook.

In the short-term, the S&P 500 index has been at the upside channel after it penetrated above the consolidation area of 3,950 levels at the close of the prior week. As the price jumped above the 3,950 barriers, the expectation is a retest of the record peak at the 3,991 levels before retreating.

However, an increased consolidation at the top and dwindling 4 hours Relative Strength Index warn of further weakness which would bring bears fully in play on a firm break of 3,950 pivots. The anticipated scenario is positioned beneath 3,900 levels with targets at 3,840 and 3,800 levels extension.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.