S&P 500 Price Analysis – March 16

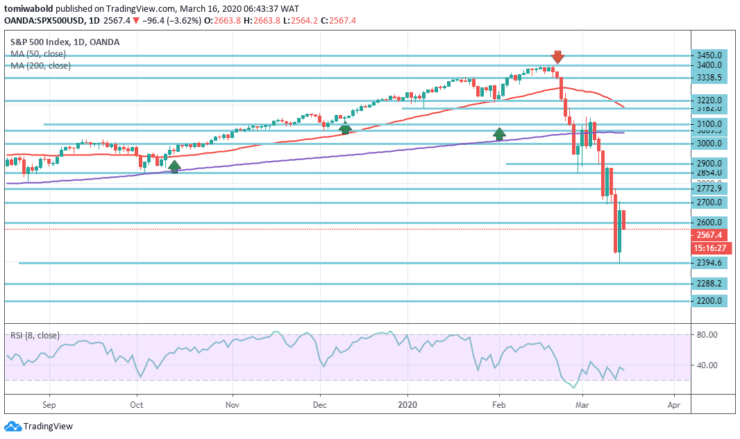

Today, it seems that market selling may continue as the S&P 500 furthers its decline again. The unexpected move by the US Federal Reserve to cut rates by 100 bp from 1% -1.25% to 0% -0.25% and the announcement of a quantitative easing program, it seems, has not yet supported the markets. With coronavirus creating chaos in the global economy and the stock markets, prospects remain unreliable.

Key Levels

Resistance Levels: 3000, 2854, 2772

Support Levels: 2394, 2288, 2200

S&P 500 Long term Trend: Bearish

The market appears to attempt to likely break below the beginning of the lower extended end of the level at 2394 to reach 2288, the lower level, which is the key turning point for the do-or-break market.

The initial level of support remains in the lower zone of December 2018 at 2394 level. The breakthrough will suggest that we are moving towards the correct decline in the bear market, which usually occurs only during recessions.

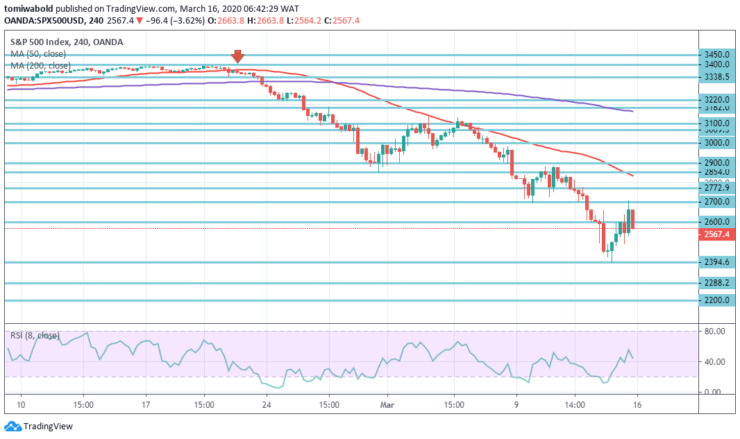

S&P 500 Short term Trend: Bearish

The S&P 500 decline may continue to grow after the completion of the short-term bearish pattern of the continuation of the “wedge”.

Although the rebound from the initial support level of 2394 remains weak, we do not recommend re-entering the market until a clear basis appears. If a breakthrough occurs below the level of 2394, then most likely the price will go first to the level of 2288, and then to the level of 2200.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.