S&P 500 Price Analysis – March 3

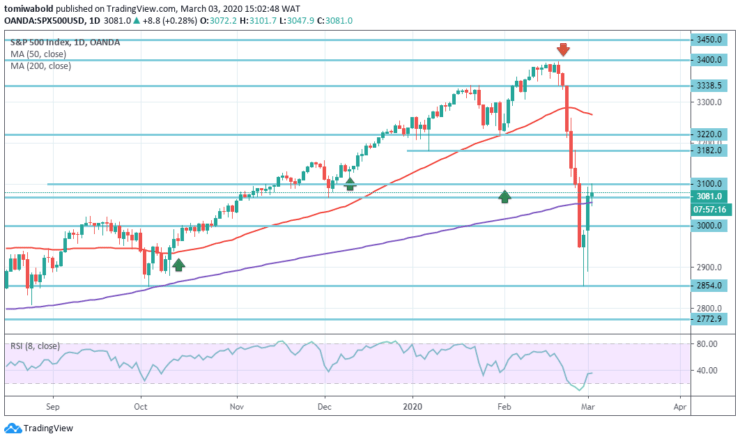

During the corresponding trading session, the S&P 500 was very volatile, while the current recovery continues past 3000/3100 levels. As investors track the situation with coronavirus and that, of course, continues to move around the markets. During the trading session on Monday, however, stock markets tried to recover, showing signs of resilience after initially gapping lower.

Key Levels

Resistance levels: 3400, 3220, 3100

Support level: 3000, 2854, 2772

S&P 500 Long term Trend: Ranging

The initial market reaction to the pandemic, in the long-term context, sees the S&P 500 erasing early gains and slumping into negative territory to reflect the disappointment.

On the other hand, the Index remains relatively resilient in a recovery mood near the 3100 handles, while it is difficult to trade in an atmosphere that features so much in the way of uncertainty, If the price remains above the 3100 levels, then the market may continue to rise.

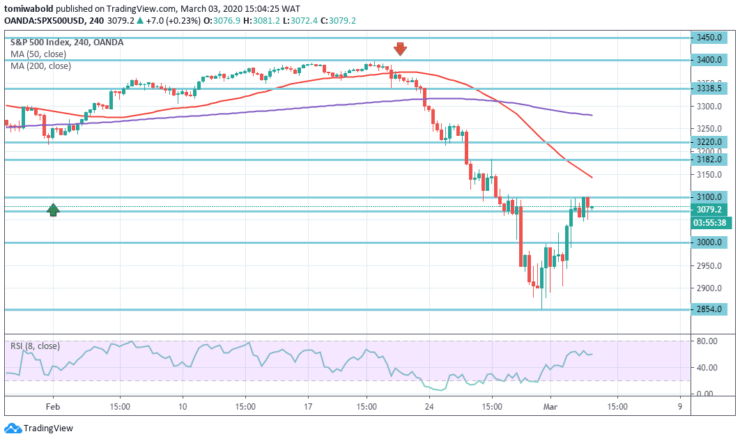

S&P 500 Short term Trend: Bearish

After an attempt to close the price gap above 3100, the Index currently trades at 3063.00, we could see an effort to hold above 3100.00; but, if it fails, the next two supports are priced in at 3000.00 and 2854.00.

If the market was to turn around and fail below Friday’s lows, not only will the 2854 level be tested but more than likely broken to the downside while the market collapses.

Instrument: S&P 500

Order: Buy

Entry price: 3069

Stop: 3000

Target: 3182

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.