S&P 500 Price Analysis – January 26

S & P 500 exited prior session with a decrease of -0.27% to a level of 3,293.6. Regardless of the retreat, the continuous rally stays unabated. US stock indices generally exited at the previous session after the advent of the Chinese coronavirus. The Centers for Disease Control and Prevention established the first casualty in the United States.

Key Levels

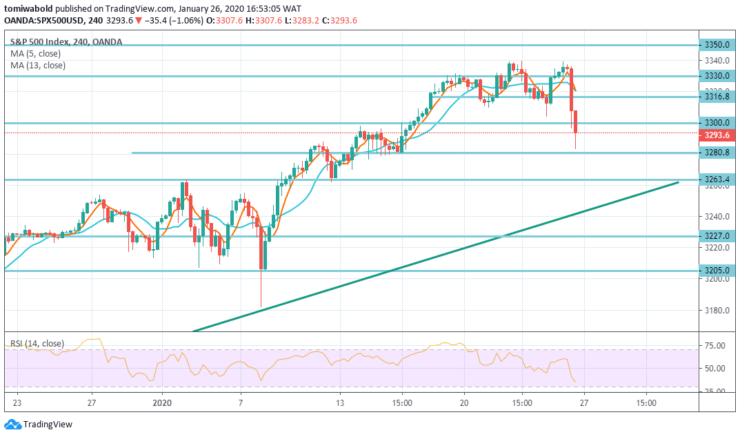

Resistance Levels: 3400, 3350, 3330

Support Levels: 3300, 3280, 3263

S&P 500 Long term Trend: Bullish

By the end of the previous trading session, the S & P 500 index fell, falling from 1.18% to 3,293.6, after a bullish increase at the beginning of last week, the retreat may find potential support near the price levels of 3300 and 3280.

The US stock index continues to trade in a bullish trend after the trendline support of the uptrend around the horizontal line at 3300. The path of least resistance is directed upward, and if the bulls overcome the resistance level of 3350, the market is likely to continue the bullish trend, trading at 3400 and 3450 levels.

S&P 500 Short term Trend: Bullish

Meanwhile, on the other hand of the 4-hour time frame, while the support level on the 3 205.0 stays intact, the current short-term uptrend is anticipated to expand to the 100% level from 2 853.0 to 3 069.3 with 2 772, 9 at 3,350.0 as follows.

In case the S & P 500 is trading past the level of 3300, then the bulls can aim at the levels of 3330 and 3350 in the future. In an alternative scenario, if the S & P 500 is trading beneath the 3300 levels, the bears can likely look down at 3280.8 and 3263.4 levels as targets.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.