S&P 500 Price Analysis – March 31

The S&P 500 consolidates the 4-day advance beneath the levels of 2600/2700 while big and powerful outbreak threats linger, worldwide uncertainties stay on the weak side during Monday’s initial trading session. Tactically, as per analysts at Goldman Sachs, they reasonably expect the S&P 500 to increase to 3000 levels by the close of the year.

Key Levels

Resistance Levels: 3139.0 , 2900, 2700

Support levels: 2500, 2400, 2179.3

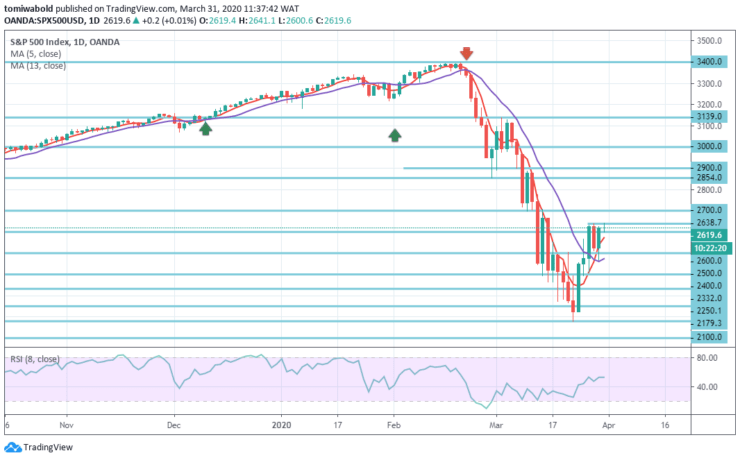

S&P 500 Long term Trend: Bearish

As shown on the daily chart, the S&P 500 consolidates a 4-day advance beneath resistance levels of 2600/2700. In the medium to long term, the reversal may expand below to the 2500 and 2400 levels. Significant resistance is shown in price levels of 2638/2700.

The bottom line is that the most recent declines are probably to see a retest except if the S&P 500 will efficiently break above the 2638 level.

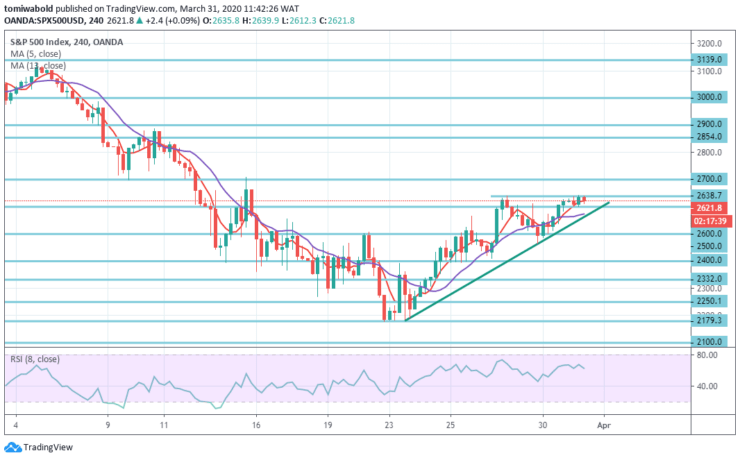

S&P 500 Short term Trend: Ranging

Through the point of view of the 4-hour time frame, the S&P 500 reveals that the index had ended a short-term bearish cycle when the market hit a level of 3139, and the index is already consolidating at 2638 level with a push against its resistance.

Besides, the corrective movement that the price is forming must continue to alter its bias, which leads to an upward rally towards the level at 2700. Additionally, the S&P 500 index may force a new restricted bearish movement in the short term that may offer the long side the potential for new consolidations.

Instrument: S&P 500

Order: Buy

Entry price: 2600.0

Stop: 2500

Target: 2700

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.