Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

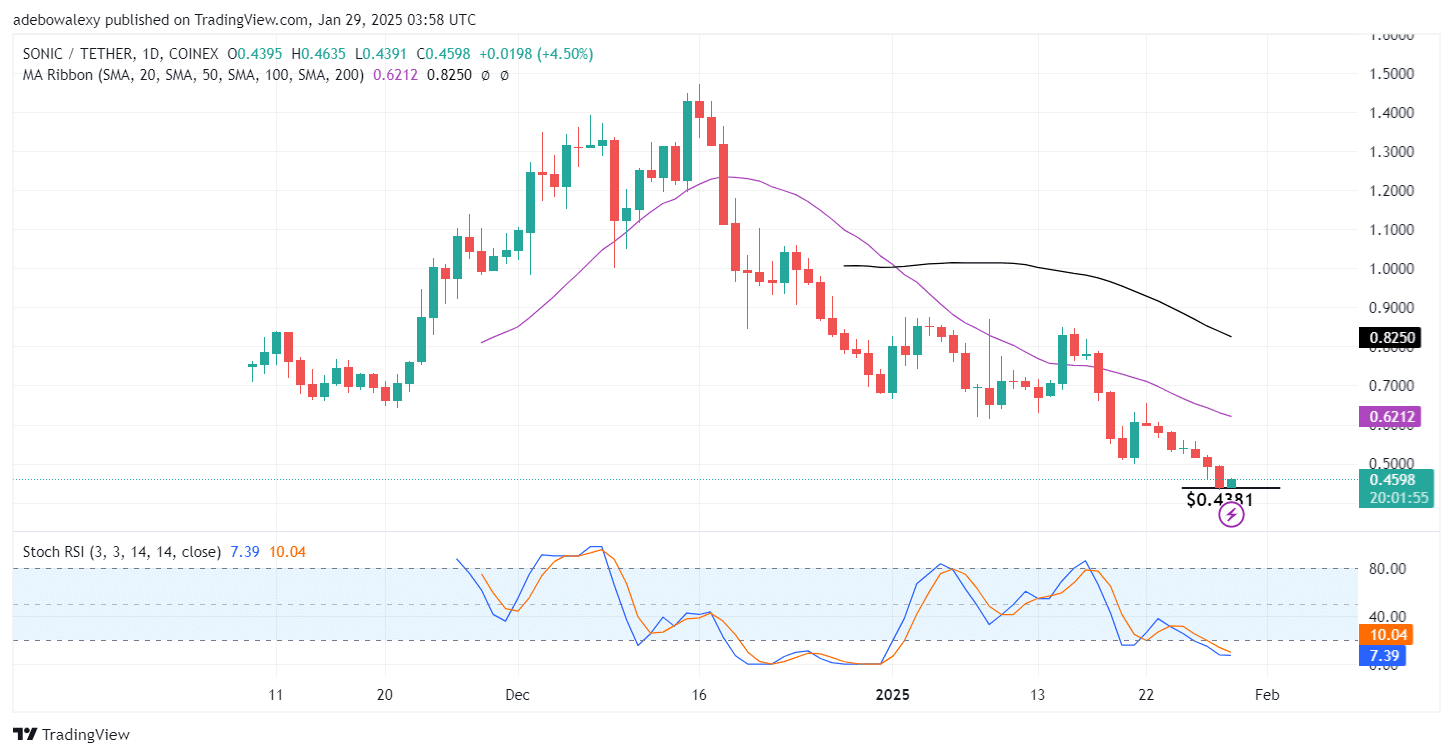

The Sonic token has been retracing to lower prices since its price action tested the $1.4000 resistance level. Since then, the market has been dominated by bearish sentiment, causing prices to decline further. As of the time of writing, the token has experienced only minimal upside retracement. Let’s analyze what may unfold in the market below.

Sonic Statistics:

Current Price of S: $0.4598

Market Capitalization: $1.32B

Circulating Supply: 2.88BT

Total Supply: 3.17B

CoinMarketCap Rank: 71

Key Price Levels:

Resistance: $0.5000, $0.7000, $0.9000

Support: $0.4000, $0.3000, $0.2000

Sonic Bulls Remain Overwhelmed

For an extended period, price action on the S token’s daily chart has been trending toward lower support levels. This indicates that price movement has remained below all available Moving Average (MA) lines for most of the recent trading sessions.

Additionally, the Stochastic Relative Strength Index (RSI) is deep in the oversold region, with the lead line tending sideways near the 0.00 mark. This suggests that bearish momentum may persist for several more sessions. Meanwhile, a green price candle has appeared off the support level at $0.4381. However, given its position, this candle may not behave differently from the previous weak bullish attempts in recent sessions.

Will S Retrace Significantly From the Current Support?

On the 4-hour Sonic chart, the latest price candle hovers just above a key support level. However, price action remains below all MA curves. Additionally, the Stochastic RSI lines have converged for a potential upside crossover just below the 50 level.

This crossover could quickly gain momentum as the indicator moves above 50, potentially pushing the market past the 20-day MA line. As a result, traders may set their short-term targets at the $0.5000 price level. If bullish momentum strengthens, the market could rise even higher in the coming sessions.

Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.