Sonic (S), the new Layer-1 blockchain developed by the team behind Fantom Opera, has posted impressive growth metrics since its December 2024 launch.

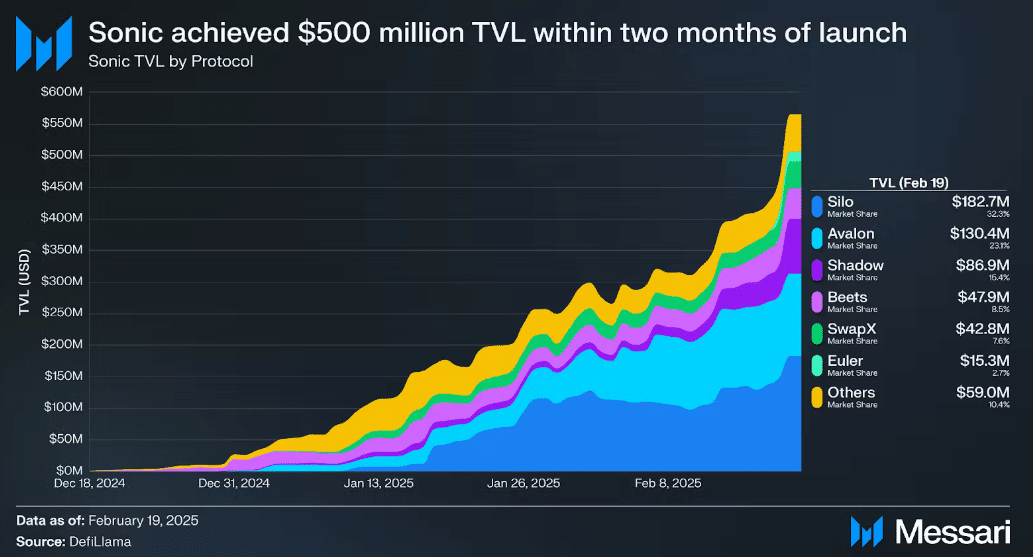

According to Messari’s Q4 2024 report, Sonic has seen a 21-fold increase in total value locked (TVL), reaching $565 million, while generating over $2.3 billion in DEX trading volume.

The blockchain has processed 26 million transactions in total, maintaining a robust daily average of 399,882 transactions. Shadow Exchange, a native DEX on Sonic, accounts for 30% of all network activity. This significant transaction volume demonstrates strong user engagement with the new network.

Sonic Network’s Technical Features Drive Adoption

Sonic stands out among EVM-compatible chains with its technical capabilities, including:

- 10,000 transactions per second with sub-second finality

- The optimized SonicVM for improved smart contract execution

- SonicDB with live pruning to reduce validator storage requirements

- Fee Monetization Program allowing developers to earn up to 90% of transaction fees

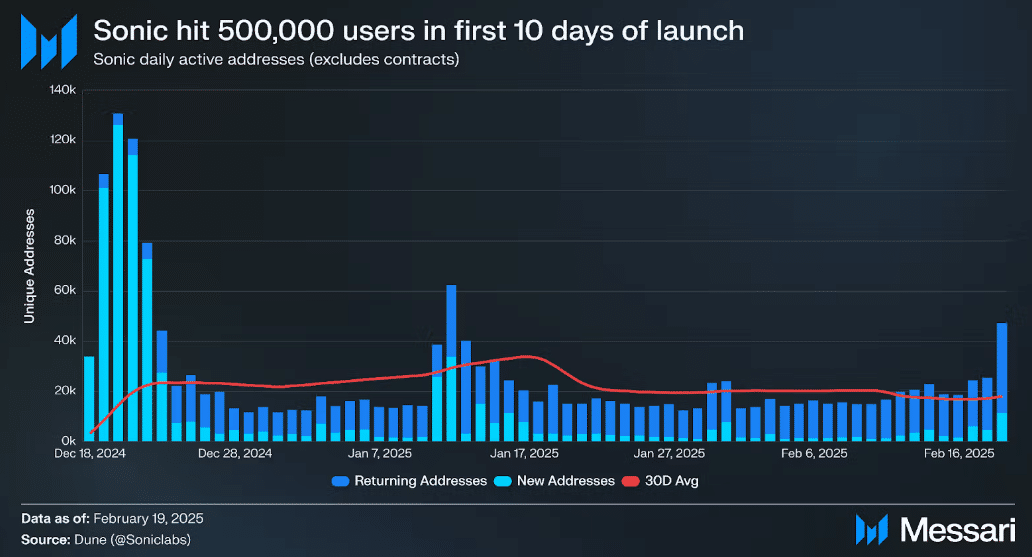

These features position Sonic as a high-performance platform aimed at DeFi applications. The network has attracted 743,323 unique wallet interactions since launch, with current daily active addresses averaging 25,650.

The stablecoin market on Sonic has expanded to $139 million, dominated by USDC.e (75%), followed by scUSD (20%) and USDT.e (5%). This growth in stablecoin adoption signals increasing confidence in the network’s stability and utility.

Strategic Token Distribution and Developer Incentives

The S token, which serves as Sonic’s native currency for transaction fees, staking, and governance, has implemented several mechanisms to encourage long-term participation:

- A 190.5 million S token airdrop (valued at $160 million) with a linear vesting schedule

- An innovative burn mechanism that penalizes early token redemption

- The Innovator Fund allocating 200 million S tokens to attract development teams

- A secure bridge called Sonic Gateway with a fail-safe mechanism

Sonic’s DEX volume distribution shows WAGMI leading with 54% market share ($1.2 billion), followed by Shadow Exchange at 36% ($819 million). Other notable DEXs include Silverswap, Equalizer, and Beets with smaller but significant shares.

Leading protocols contributing to Sonic’s TVL include lending platforms Silo ($183 million) and Avalon Labs ($130 million), followed by Shadow Exchange ($87 million), Beets ($48 million), and SwapX ($43 million).

The network’s highest transaction day to date was January 13, 2025, with 980,182 transactions processed. Gaming is also gaining traction on Sonic, with Sacra contributing 8% of all onchain activity.

With its blend of technical performance, developer incentives, and strategic token distribution, Sonic has quickly positioned itself as a significant player in the Layer-1 blockchain space, building on the momentum from its parent chain, Fantom Opera.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.