Solana (SOL), the blockchain platform known for its high-speed transactions and low fees, is grappling with significant challenges that could impact its near-term prospects in the cryptocurrency market.

Recent data and regulatory developments have cast a shadow over Solana’s momentum, highlighting the volatile nature of the crypto space.

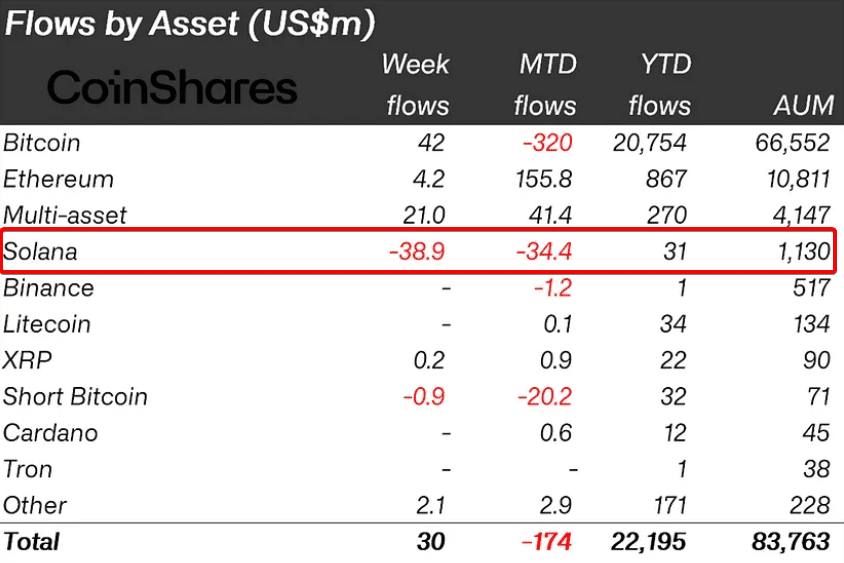

Record-breaking Outflows

According to a recent CoinShares report, Solana experienced unprecedented outflows of $39 million last week, marking its largest negative flow on record. This sharp reversal comes on the heels of $4.5 million in inflows the previous week, indicating a rapid shift in investor sentiment.

The primary driver behind this exodus appears to be the waning interest in Solana-based meme coins. These tokens, which had previously fueled significant activity on the network, have seen a marked decrease in trading volumes.

Solana ETF Aspirations Hit Regulatory Roadblock

Compounding Solana’s challenges is the ongoing regulatory scrutiny from the U.S. Securities and Exchange Commission (SEC). The regulator’s stance on Solana’s potential classification as a security has thrown a wrench into plans for Solana-based exchange-traded funds (ETFs).

VanEck and 21Shares had submitted applications for Solana ETFs. However, their 19b-4 forms, crucial for initiating the approval process, were recently removed from the Cboe website. This development suggests that the SEC has communicated concerns to prospective issuers regarding SOL’s security status.

The regulatory hurdle traces back to June 2023, when the SEC labeled Solana and 11 other tokens as potential securities in lawsuits against major cryptocurrency exchanges. This classification implies that these assets may have been “offered and sold as investment contracts,” subjecting them to stricter regulatory oversight.

Looking Ahead

The confluence of record outflows, regulatory challenges, and rising competition paints a complex picture for Solana’s immediate future. While some experts, like Nate Geraci, President of the ETF Store, suggest that a Solana ETF is unlikely under the current administration, others speculate that alternative markets like Canada might lead the way in approving such products.

Yes…

Solana ETF not happening anytime soon under current administration. https://t.co/z18gRIFzEr pic.twitter.com/zSL5PMjDC6

— Nate Geraci (@NateGeraci) August 17, 2024

As the crypto landscape continues to evolve, Solana’s ability to navigate these hurdles and reinvigorate investor confidence will be crucial.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.