Key Highlights

Solana hovers above the $20 support

SOL/USD reaches an oversold region

Solana ( SOL) Current Statistics

The current price: $20.68

Market Capitalization: $11,155,450,647

Trading Volume: $539,784,438

Major supply zones: $60, $80,$100

Major demand zones: $50, $30, $10

Solana (Sol) Price Price Long-Term Prediction: Bearish

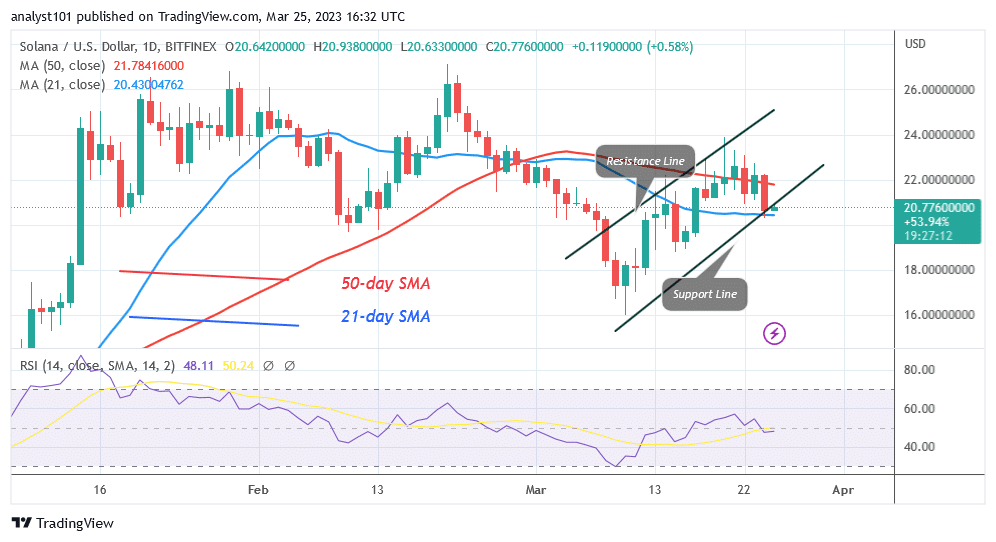

Solana’s (SOL) price dropped to the bearish trend zone as it risks declining to $19.40. The price of the crypto asset at the time of writing is $20.72. On March 24, the cryptocurrency’s price fell below the moving average lines but stayed above the 50-day SMA. Solana is now trading between the moving average lines. The altcoin is likely move in a range for a few days. If the coin breaks below the 21-day AMA, it will go to a low of $19 or $16 on the downside. The altcoin will restart its upward trend if the price moves above the 50-day SMA. The prior highs of $24 and $26 will be revisited.

Solana (Sol) Price Indicator Analysis

According to the Relative Strength Index for period 14, Solana is in a downtrend at level 47. The bearish trend zone is where the altcoin is most likely to decrease. But, because the price bars are pinned between the moving average lines, Solana will start a range-bound move. The oversold area of the market is now under selling pressure. It is below the daily Stochastic of level 20. Market bearishness will eventually run its course.

What Is the Next Move for Solana (SOL)?

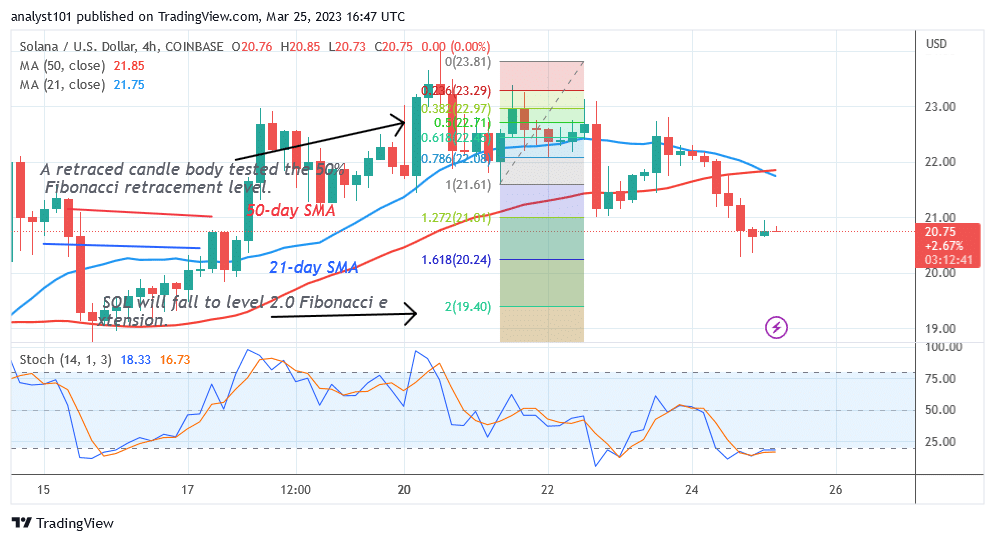

On the 4-hour chart, Solana’s price is decreasing as it risks declining to $19.40. Since March 24, the crypto asset has been circling over the $20 support. According to the price indication, Solana will continue to fall until it reaches level 2.0 of the Fibonacci extension, or $19.40.

You can purchase crypto coins here. Buy LBLOCK

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.