There may be a pullback at $23 level

SILVER Price Analysis – 01 November

Silver’s price may rise and test the $24 and $25 resistance levels if buyers are able to hold the $22 price level and the $23 resistance level is breached. With increased selling pressure, the $21 and $20 range would be the targets of a lower price break.

XAGUSD Market

Key Levels:

Resistance levels: $23, $24, $25

Support levels: $22, $21, $20

XAGUSD Long-term trend: Bullish

Silver’s long-term outlook is promising. The white metal declined to the previous low at the $20 support level as sellers increased their pressure on it. Bulls created a powerful bullish engulfing candle to defend the level that was previously indicated. The price rises and breaks through the $21 resistance mark. With a target price of $23, silver prices have been rising gradually since buyers took control of the market on October 6.

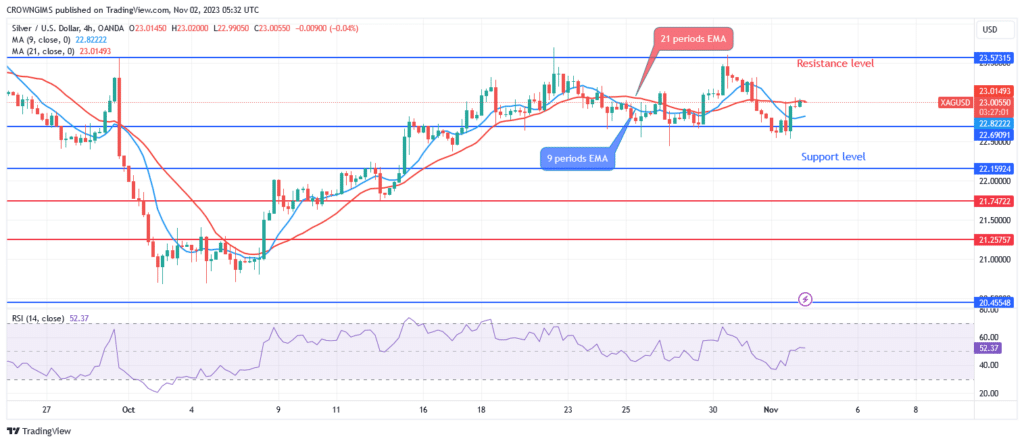

The exponential moving averages (EMAs) for the 9 and 21 periods are currently being traded above by the price of silver. At point 54, the period 14 signal lines of the relative strength index are bending upward. Silver’s price may rise and test the $24 and $25 resistance levels if buyers are able to hold the $22 price level and the $23 resistance level is breached. With increased selling pressure, the $21 and $20 range would be the targets of a lower price break.

XAGUSD Medium-term Trend: Bullish

The bullish phase is seen on the 4-hour XAGUSD chart. The chart displayed a bullish “double bottom” reversal pattern, suggesting that silver was about to surpass the $23 barrier level. Due to rising demand, the price of white metal broke up $22 level. The $23 resistance level has been tested and pulled back.

Silver’s price, which is presently trading above important dynamic resistance levels, suggests that the market is positive. The relative strength index’s up-pointing period 14 signal line is currently at 53. That is a purchase signal being sent out.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.