Sellers are dominating Silver market

SILVER Price Analysis – 08 February

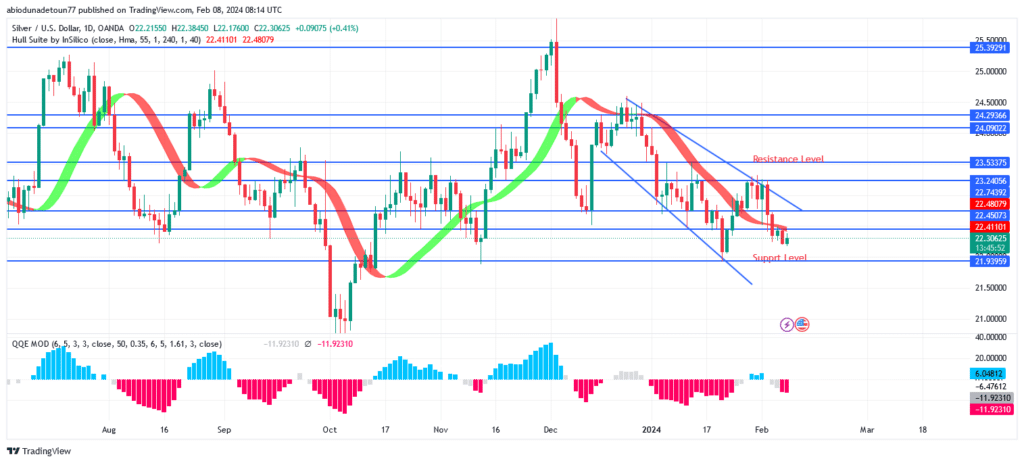

If there is a lot of selling pressure, a lower price breach of $21 would aim for the $20 to $19 region. If buyers can hold the $21 price level and the $22 resistance level is broken, silver’s price may rise and test the $23 and $24 resistance levels.

XAGUSD Market

Key Levels:

Resistance levels: $22, $23, $24

Support levels: $21, $20, $19

XAGUSD Long-term trend: Bearish

Silver’s long-term outlook is bearish. As buyer demand grew, the price rose to the $26 barrier. When buyers remained on the aforementioned level and the bulls increased their pressure against the sellers’ push, the white metal reached its prior high at the $26 barrier level. A few days ago, bears were able to drive the price down to $21. After a robust bullish candle developed, the price inclined to retest the $23 level. Last week, sellers dominated the market and the price is facing $21 level.

The price of silver is currently trading below the Hull Suite signal, as indicated by a histogram below zero. The QQE MOD the best forex signal indicators are showing a bearish signal. If there is a lot of selling pressure, a lower price breach of $21 would aim for the $20 to $19 region. If buyers can hold the $21 price level and the $22 resistance level is broken, silver’s price may rise and test the $23 and $24 resistance levels.

XAGUSD Medium-term Trend: Bearish

The XAGUSD 4-hour chart is behaving bearishly. A negative reversal was signaled by a bearish engulfing candle pattern close to the $24 barrier level. When silver was first starting to increase, $24 was a barrier. The sellers’ resolute defense of the previously mentioned level caused the price to plummet to the $22 level. The price declined last week to retest the $22 mark. The white metal is currently trading at a historical low of $21.

The silver price, which is currently trading below important dynamic resistance levels, is a harbinger of a down market. The QQE MOD indicates the sell direction.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.