Sellers dominate Silver market

SILVER Price Analysis – 18 January

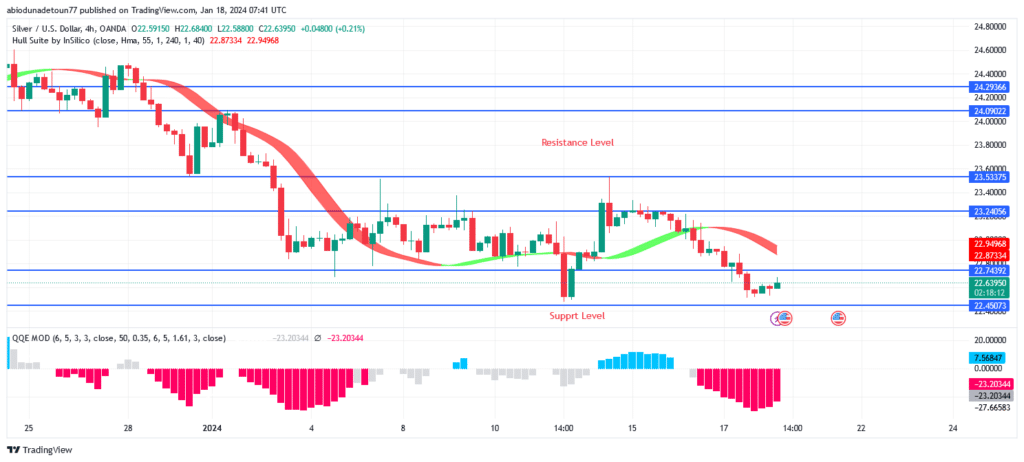

The $20–$21 area would be the objective of a lower price breach of $22, if there is significant selling pressure. Silver’s price may rise and test the $23 and $24 resistance levels if buyers can hold the $21 price level and the $22 resistance level is breached.

XAGUSD Market

Key Levels:

Resistance levels: $22, $23, $24

Support levels: $21, $20, $19

XAGUSD Long-term trend: Bearish

The long-term forecast for silver is bearish. The price increased to the $26 barrier as demand from buyers increased. The white metal hit its prior high at the $26 barrier level as buyers held onto the previously mentioned level and the bulls applied more pressure. Bears were able to hold the $23 mark yesterday and produced a strong bearish candle. The price is currently declining towards the support level of $21.

With a histogram below zero, the price of silver is currently below the Hull Suite signal. The QQE MOD indicators are showing a bearish signal. The $20–$21 area would be the objective of a lower price breach of $22, if there is significant selling pressure. Silver’s price may rise and test the $23 and $24 resistance levels if buyers can hold the $21 price level and the $22 resistance level is breached.

XAGUSD Medium-term Trend: Bearish

The 4-hour chart of XAGUSD exhibits bearish behavior. An inverted pin bar candle pattern near the $23 resistance level indicated the start of a bearish reversal. The $23 level was resistance when silver was first beginning to fall. The price moved between the $23 and $22 levels as a result of the sellers’ continued defense of the previously indicated level. At the moment, the white metal is pressing towards $21 level.

The price of silver, which is presently trading below significant dynamic resistance levels, suggests that the market is fallen. The direction displayed by the QQE MOD is sell.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.