Silver Price may surpass $23 level

SILVER Price Analysis – 19 October

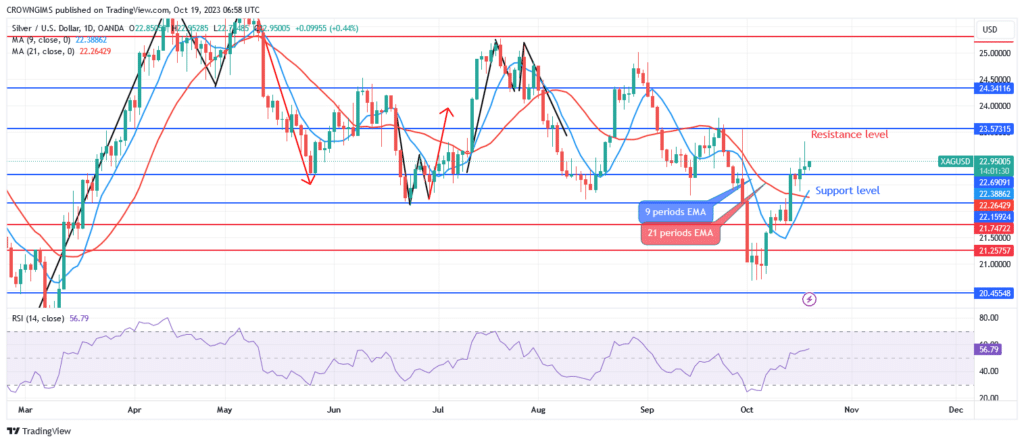

Silver’s price may rise and test the $24 and $25 resistance levels if buyers are able to hold the $22 price level and the $23 resistance level is broken. Additional selling pressure would push the price down to the $21 and $20 range, which would be the target of a lower price break.

XAGUSD Market

Key Levels:

Resistance levels: $23, $24, $25

Support levels: $22, $21, $20

XAGUSD Long-term trend: Bullish

Silver’s long-term outlook is positive. The white metal moved to the previous low at the $20 support level as sellers increased their pressure. Bulls created a powerful bullish engulfing candle to defend the previously noted level. The price rises and breaks through the $21 resistance mark. Buyers have been in control of the silver market since October 6, and prices have been rising gradually, currently targeting $23 level.

The exponential moving averages (EMAs) for the 9 and 21 periods are currently being traded above by the price of Silver, and the EMA is expanding as it approaches the EMA for the sluggish period. At 57, the period 14 signal lines of the relative strength index are bending upward. Silver’s price may rise and test the $24 and $25 resistance levels if buyers are able to hold the $22 price level and the $23 resistance level is broken. Additional selling pressure would push the price down to the $21 and $20 range, which would be the target of a lower price break.

XAGUSD Medium-term Trend: Bullish

The bullish phase is seen on the 4-hour XAGUSD chart. A bullish reversal chart pattern with a “double bottom” signaled the start of silver’s rise above the $21 resistance level. The demand from purchasers has caused the price of white metal to surpass $22 level. The immediate objective is a test of the $23 resistance level.

A bullish market is indicated by the price of silver, which is currently trading above key dynamic resistance levels. The relative strength index’s up-pointing period 14 signal line is currently at a level of 61. A purchase signal is being emitted by it.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.