Silver Price may increase to $25 Level

SILVER Price Analysis – 21 September

Silver price may fall and test the $21 and $20 support levels if sellers can hold the $23 price level and the $22 support level is broken. If buyers applied more pressure, breaking the $23 level would be the result. The targets of a price break higher would be the $24 and $25 price levels.

XAGUSD Market

Key Levels:

Resistance levels: $23, $24, $25

Support levels: $22, $21, $20

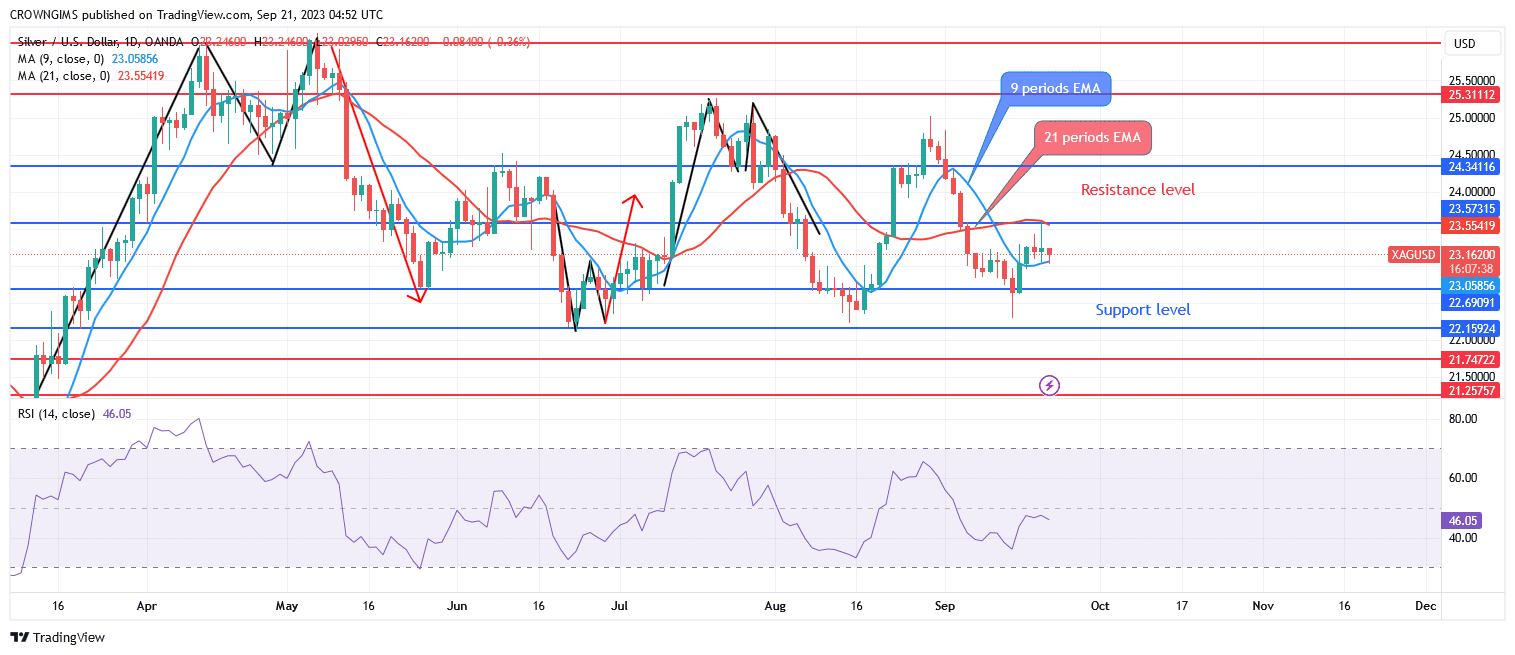

XAGUSD Long-term trend: Bearish

Silver’s long-term outlook is unfavorable. The white metal is heading toward the previous low at the $22 support level as sellers apply further pressure. At $22, the price found support on August 15 and later rose. On August 30, the $25 barrier level was once again tested, although bullish pressure decreased. The price of silver then broke through the $24 support level. As a result, on August 30, Silver’s price dropped to a level of $23. It is now rejecting the $22 level.

White metal’s price is between both the 9-period and 21-period exponential moving averages, and the fast EMA has crossed below the slow EMA in a downward manner. The period 14 signal lines of the relative strength index are bending downward at 45. Silver’s price may fall and test the $21 and $20 support levels if sellers can hold the $23 price level and the $22 support level is broken. If buyers applied more pressure, breaking the $23 level would be the result. The targets of a price break higher would be the $24 and $25 price levels.

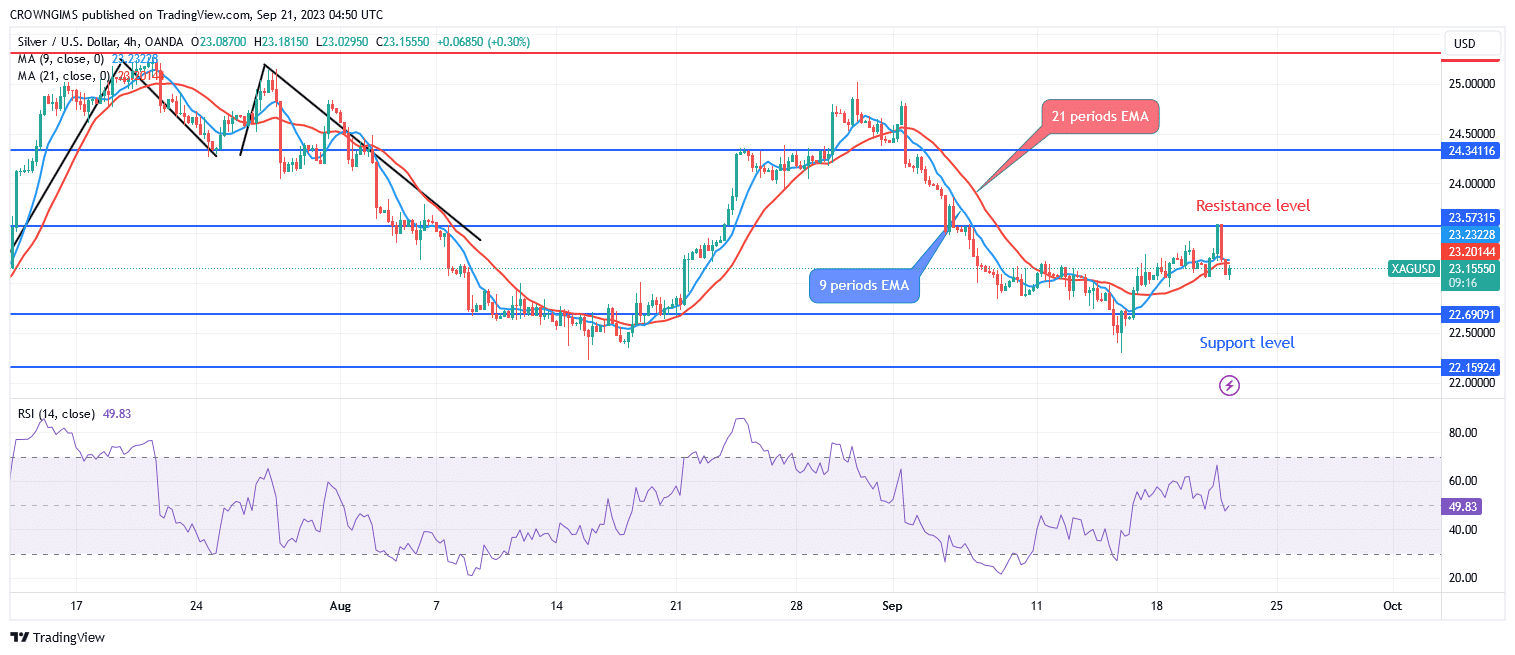

XAGUSD Medium-term Trend: Bullish

The bullish phase is seen on the 4-hour XAGUSD chart. When the “double top” bearish reversal chart pattern appeared, silver started to fall below the $24 level of support. The price of white metal has surpassed $23 due to sellers’ pressure. The $22 support level has been tested and bounces up from the just mentioned level.

The price of silver, which is currently trading above significant dynamic resistance levels, is pointing to a bullish market. The period 14 signal line of the relative strength index, which is currently at a level of 50, points up. It is emitting a signal to buy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.