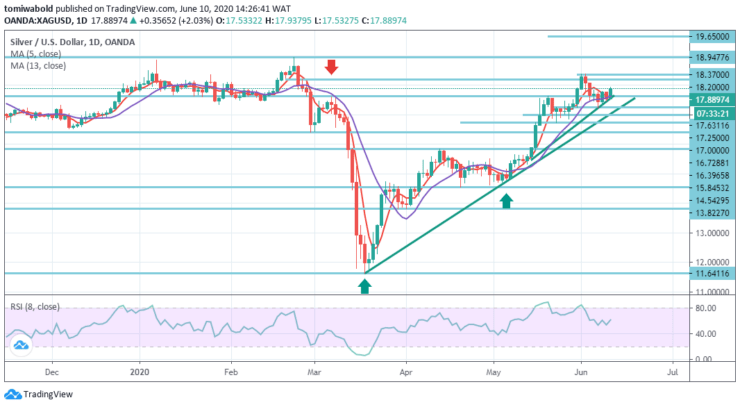

XAGUSD Price Analysis – June 10

SILVER finished at $17.53 on Tuesday and lost $22.0 (-1.22 percent). That being said, in today’s session, Silver (XAG) is growing as anticipated while buyers are about to challenge upside barriers at the $17.90/$18.00 level. As the market is steaming up and trading high back to the days before.

Key Levels

Resistance Levels: $19.65, $18.94, $18.20

Support Levels: $17.25, $16.72, $15.84

The pair closed lower but above the opening of the preceding day creating a bearish Harami Candle after moving lower in the corresponding session. Prices have risen back up but still below the $18.20 level main technical barrier, which is likely to serve as a forward-looking resistance.

The market may again run into bears at the level of around $18.20 for the third time in a row after finding sellers in the same area in previous sessions and at $18.37 a few days ago. The last time this happened on June 2, on the very next trading day, SILVER ended up losing about 3 percent.

Silver price bounced from $17.63 level on the 4-hour time frame, up 1.30 percent on a day, as seen Wednesday during the European session. Even so, a bullish technical structure of a rising trend is yet to be confirmed by the white metal, on the four-hour chart to validate further buying.

On the other hand, the pair is supposed to find support at $17.63, and a decline through might take it to the next level of support at $17.25.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.