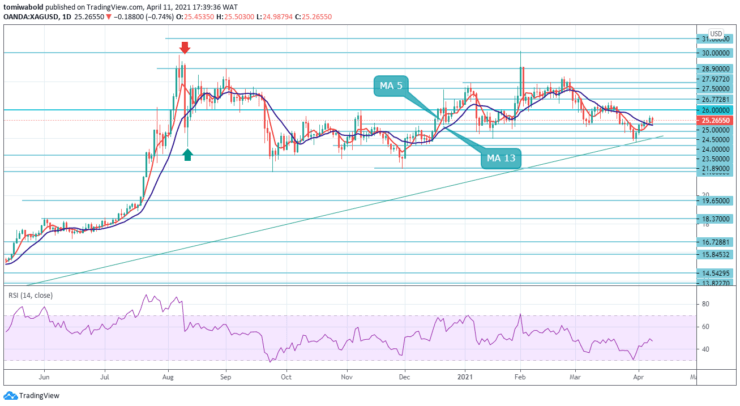

XAGUSD Price Analysis – April 11

During the previous session, the price of the white metal was under tremendous pressure and fell below the mid $25.00 mark. The selling bias would be reversed if the price rises above the $25.00 breakpoint. The lack of long-term downside is likely since US government bond yields have fallen back to pre-release levels.

Key Levels

Resistance Levels: $28.90, $27.50, $26.00

Support Levels: $25.00, $24.50, $24.00

The reversal is supported by the XAGUSD’s inability to attempt the horizontal level at the $26 level from recent lows while remaining above the ascending trendline support at $23.78. The support level at $25.00 will be the level to beat for the bears. It should be noted that the ranging RSI conditions are likely to bolster further consolidation.

Although attempting to rebound, the white metal is currently trading with minor weakness about the $25.00 mark. If Silver price trades above the $26.00 level confluence zone, on the other hand, the upside momentum can gain traction and cause buy orders, apparently triggering an abrupt upside move in silver towards the $27.50 high level.

The XAGUSD price is expected to trade sideways in the near term before it flips moving averages 13 into support, which is located above the $25.50 mark. Bears would set their sights on $25.00 as an immediate target, with a breach risking a move towards $24.50.

Bearish short-term analysis and negative sentiment aid bears, who are aiming towards oversold conditions for the time being, although some price adjustment may be anticipated. Upticks above the ascending trendline are expected to provide better opportunities to re-join the bullish market in the coming session.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.