XAGUSD Price Analysis – June 8

During Monday’s European session, despite taking a U-turn from near-term low, Silver price take offers near $17.22 level, up 1.50 percent on a day. The precious metals sector was projected to decline but it seems to rebound as the star performer among the precious metals complex against the greenback, Silver shines.

Key Levels

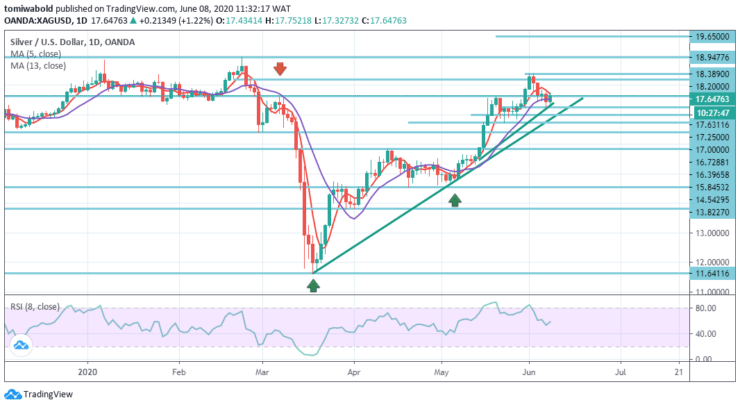

Resistance Levels: $19.65, $18.94, $18.20

Support Levels: $17.25, $16.72, $15.84

A test of the trendline on the daily chart had been conducted in favor of the price increases for Silver in the present. The second scenario would be a recovery of the downward channel’s upper range. Changing the XAGUSD quotes growth option might be a $15.84 level decline and a collapse of the region.

This may suggest a weakening of the support level and a steady decline in Silver prices with a destination beneath $13.82 level. Validation of the upward trend progress would be a decline of the downward channel’s upper border and a closing beyond the $18.20 mark. This may suggest an increase in Silver’s price rise.

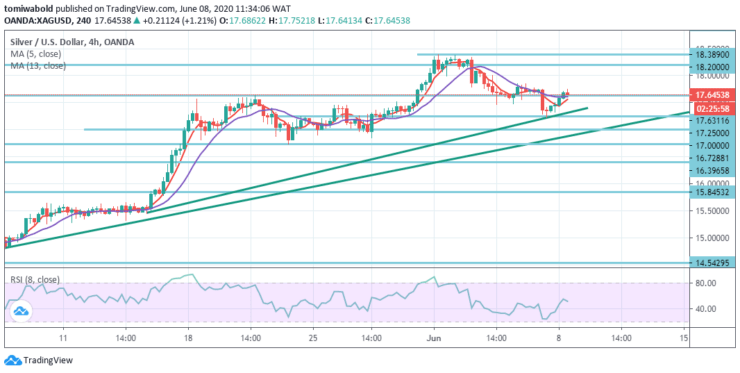

During the recent declines, on the 4-hour time frame, the bulls rebounded as an immediate launch pad around the convergence zone of the upward trendline and a near-term horizontal support level of $17.25 push price up.

Alternatively, an upside-down of the horizontal resistance zone, presently close to the $18.20 level, may push prices to the new month’s high of around $18.38 level. Although bulls are less likely to rule when they clear upside barriers beyond the moving averages.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.