XAGUSD Price Analysis – August 10

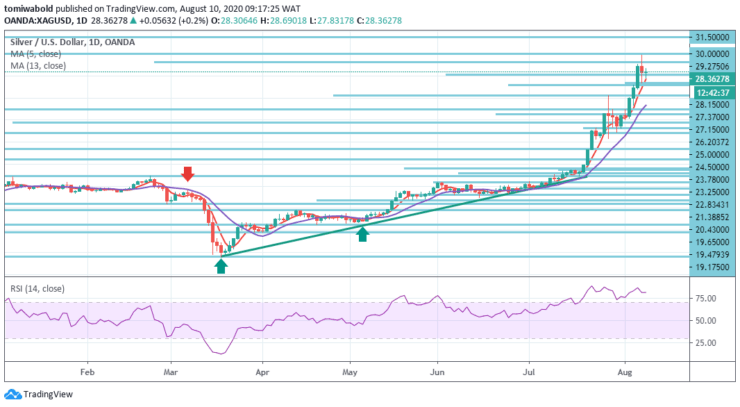

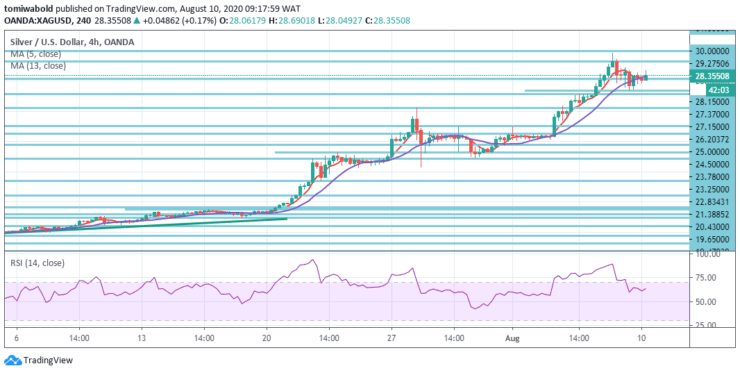

Silver prices drop to a level of $27.83 during the early European session on Monday. The remarkable run-up in the precious metals market is starting as XAGUSD manages to defy pullback at $29.85 level from its recent peak, thus rising almost vertically, following today’s intraday low of $27.83 level.

Key Levels

Resistance Levels: $31,50, $30.00, $29.27

Support Levels: $28.15, $27.15, $26.20

As seen on the daily, during the further weakness of the metal beneath $28.15 mark, the pair was bolstered by an upward-moving average of 5 around $27.83 mark, which could become the key as it holds the base for the anticipated north run revisiting its $30 level.

Alternatively, a $27.15 level downside release may renew the run-down of the bullion into the $26.00 level zone. In a scenario where the bulls manage to remain optimistic over a $30.00 threshold, upside momentum continuity may return to the charts.

In the short term Silver’s next upside technical aims are $29.27 level and $30.00 level an ounce. The pair is supposed to find support at $27.15 level, and a decline through could take it to the next support level of $26.20 level. The pair is set to reach its initial level of resistance at $29.27, and a spike through would push it to the next level of resistance at $30.00.

Nevertheless, the latest setbacks in the quote gain support from overbought RSI conditions, which in turn highlights a $19.32-level ascending support line from low of July 17, as a nearby rest level. The potential for silver already looks bullish as weak dollars and the demand for safe havens also reinforce the metal.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.