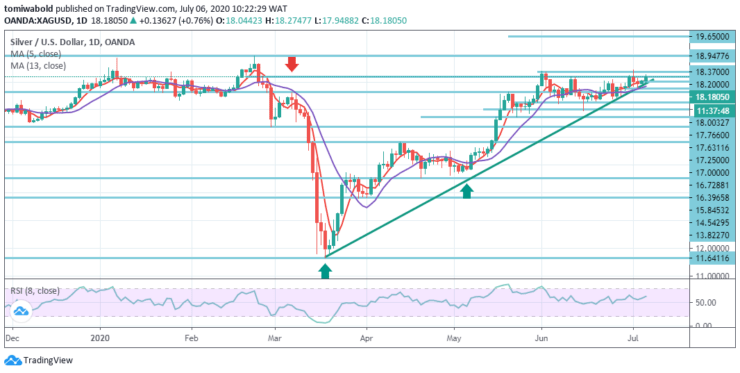

XAGUSD Price Analysis – July 6

Silver (XAGUSD) indicates a strong, lower-price pattern that supports further upside. Since gaining some few pips higher today on low volume, the pair began the day at $18.04 level about 0.92 percent higher. Since regaining from the recent selling pressure at $17.76 level the upside traction continues for $18.37 level retest.

Key Levels

Resistance Levels: $19.65, $18.94, $18.37

Support Levels: $18.00, $17.63, $17.25

The pair is trading up to 0.92 percent higher on the daily chart after the open, the pair tended to spike up early in the session as bulls took charge and may exit the day beyond its opening level. The trend is bullish while beyond the $18.00 mark, indicating a medium- to long-term, intact uptrend.

Once the white metal can’t completely breach through the main level of technical resistance at $18.20 to reach the next level at $18.37, the market may exit beneath and retrace to the level of support at $17.63. Selling could escalate once the price shift beneath the $17.63 level swing low where more selling stops may be triggered.

Silver aimed to crack the lower boundary of the prior week’s neutral zone, but the efforts proved ineffective as the ascending trendline supporting the bulls once again protected the bears at $17.76 level. At the moment the short-term risk appears neutral-to-positive and there is a chance of another retest to the trendline.

The pair is supposed to find initial support at $18.00 level, and a decline through could take it to the next $17.76 support level. The pair is supposed to meet its initial resistance at $18.20 level, and a spike through may usher it to the next $18.37 resistance level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.