XAGUSD Price Analysis – August 5

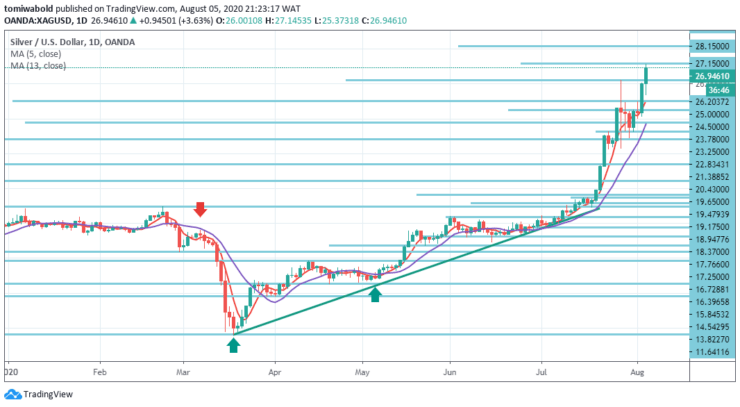

The white metal registered the highest level for 7 years, as bulls propel price beyond $27.00 mark during early day trading. Failures to progress past $27.15 levels, however, indicate a greater trend for the short term. Silver had another bullish session on Wednesday and now has a huge 48 percent year-to-date results.

Key Levels

Resistance Levels: $30.00, $28.15, $27.15

Support Levels: $25.00, $23.78, $21.38

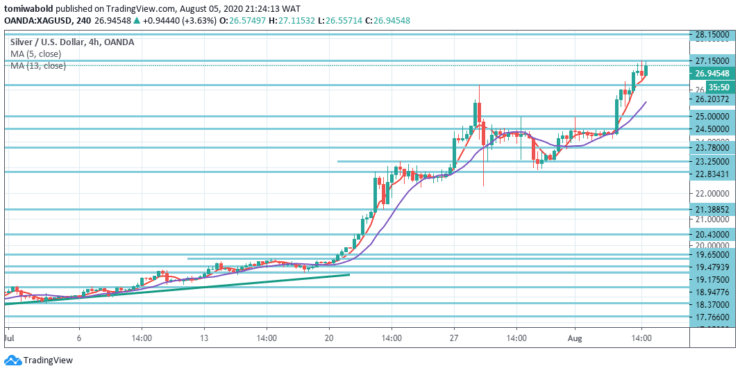

Taking a look at the above chart, XAGUSD appears to have encountered some resistance at level $27.15. If there is to be a major correction then the previous wave high at the green resistance line could be an area of support at $26.20 level.

During the past, the same zone was a strong area of resistance and this time round might tend to mitigate losses. If the level drops, then at the next main horizontal support level there is another defense zone at $24.50 level.

The bulls are currently supporting an optimistic relative strength index trend on the 4-hour time frame to hit $27.15 level again in a second attempt to breach upside. The barrier zones at levels of $27.95 and $28.15 may, however, challenge the further upside of the commodity.

While $25.00 level is the main support to consider ahead of the primary horizontal support level close to $23.78 during the metal’s pullback. For a situation where the quote declines beneath the level of $23.78, the $21.38 support level might be in the limelight as a downside breach of the same may encourage the bears.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.