Sellers oppose buyers at $37 line

SILVER Price Analysis – 31 July

If the price is higher than $38 and a lot of people are purchasing it, it will attempt to move up into the $39–$40 range. However, if merchandisers can maintain the $38 pricing position and the $35 support position is broken, the price of silver might decline and test the $34 and $33 support possibilities.

XAGUSD Market

Key Levels:

Resistance levels: $37, $38, $37

Support levels: $36, $34, $33

XAGUSD Long-term trend: Bearish

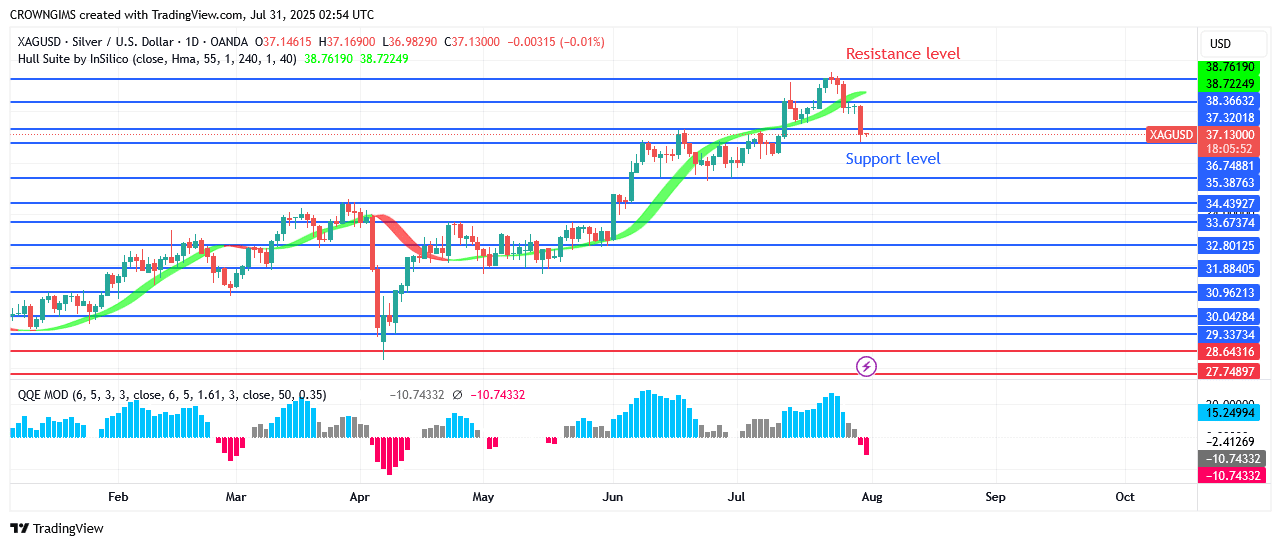

The daily chart shows a negative outlook. Silver bounce off $37 resistance level. Since April 24, buyers seem to have taken the lead in daily chart requests. Strong consumer demand caused prices to rise by $38 over the previous month, but as buying stayed steady and bulls gained ground, the white essence began to soar. Over the last two days, bears have been more active, and yesterday they continued their bearish endeavor to challenge bulls at the level that was previously advised. The urge started to shift from the $38 hedge to the $36 hedge when a double top map pattern appeared.

The price of silver is lower than the Hull Suite forex signals index, and the histogram is below zero. One of the best forex signal indicators, the QQE MOD, is currently displaying a negative signal. It will try to climb up into the $38–$39 range if the price is more than $39 and many people are buying it. However, the price of silver may drop and test the $34 and $33 support possibilities if merchandisers are able to hold onto the $37 pricing position and the $36 support position is broken.

XAGUSD Medium-term Trend: Bearish

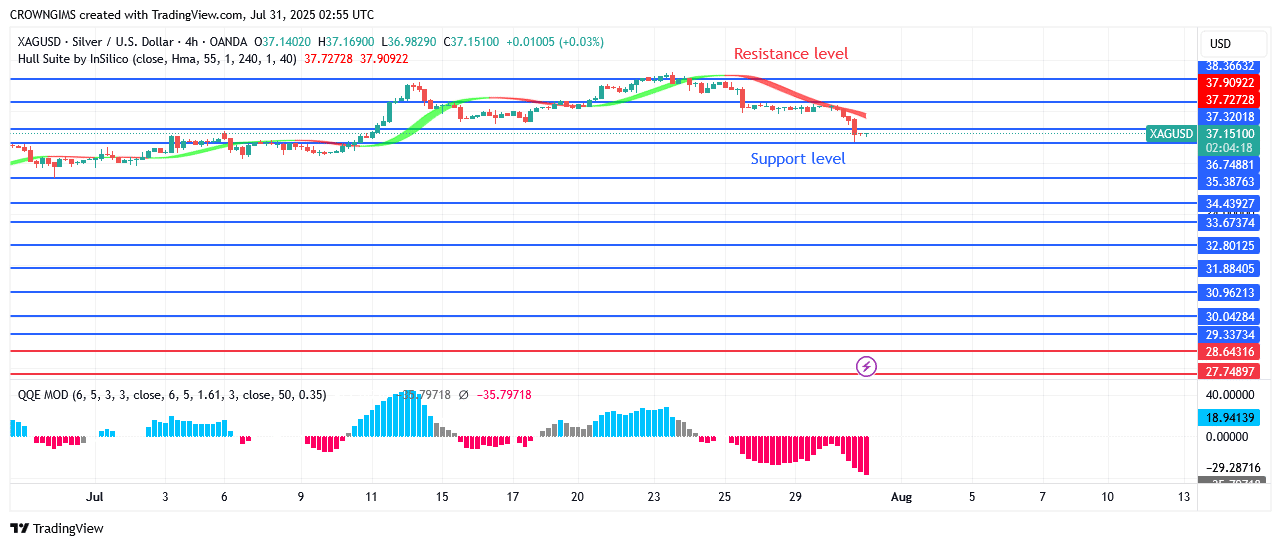

The 4-hour chart of the XAGUSD indicates a downward trend. A few weeks ago, at about $30, a double bottom map pattern appeared, indicating a major shift in direction. The $32 threshold is Silver’s first challenge. Exceeding the pre-established price arrestment was prohibited. Prices are currently more than $35 a unit because of the guests’ restricted purchasing power.

Start using a world-class auto trading solution

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.