Key Resistance Zones: 3300, 3400, 3500

Key Support Zones: 2800, 2700, 2600

In 2020, SHCOMP made a brief uptrend as the index rises from level 2700 to level 3500. Later, the index pulled back to resume consolidation on the upside. The brief uptrend reached the high of level 3456.721 in August. After the resistance, the market resumed a sideways move between levels 3200 and 3500. These levels are yet to be broken at the time of writing.

Shanghai SE Composite Index (SHCOMP) Price Predictions: Monthly Chart

The brief upward move was resisted at level 3500 which caused the index to fall in September and October. The index resumed upward in November and December to retest level 3500 resistance.

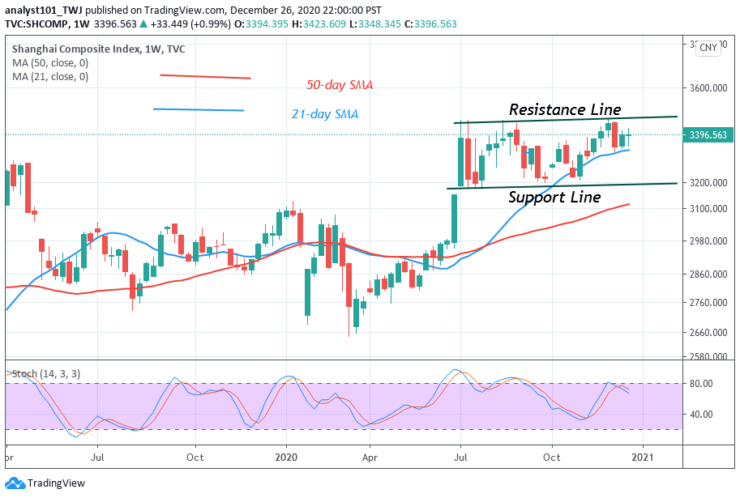

Shanghai SE Composite Index (SHCOMP) Price Predictions: Weekly Chart

On the weekly chart, the index has been fluctuating between level 3200 and 3500 after the upward move in July. Buyers and sellers are in a price tussle in that range as neither of them could break the range-bound levels.

Conclusion

The year 2020 could bring the collapse of China’s economy. This was as a result of fears over the COVID-19 which triggered a sharp fall in Chinese shares when the market reopened after the Lunar New Year holiday. The Shop index closed nearly 8% lower, its biggest daily drop for more than four years. The stock market may rise to 2021. The Shcomp gained 0.99% and the Hang Seng rose 0.16%. and Nikkei 225 lost 0.04%.

.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.