Real World Asset (RWA) tokenization is experiencing significant growth in 2025.

However, this expansion brings complex security risks that extend far beyond traditional smart contract vulnerabilities. The sector now faces hybrid threats that blend on-chain and off-chain attack vectors.

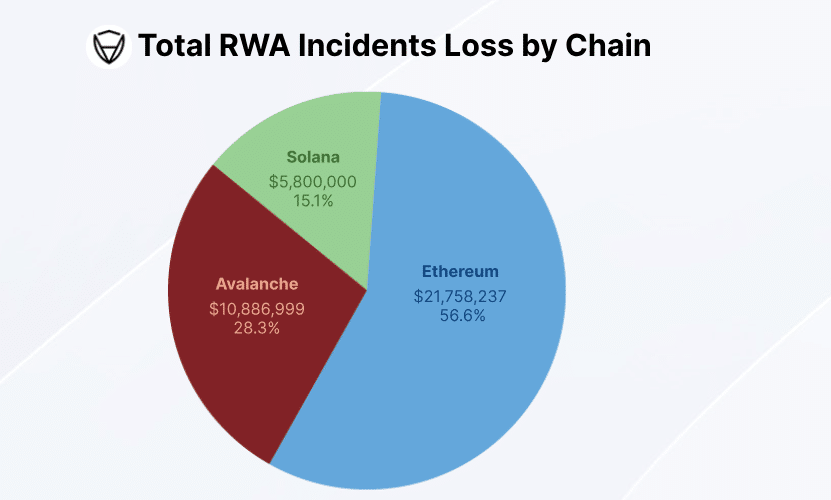

Recent data shows RWA-specific exploits caused substantial losses in the first half of 2025. These incidents represent a shift from earlier years when credit defaults dominated the threat landscape.

Today’s attacks focus more on operational security failures and on-chain exploits.

The attack surface for RWA protocols is much broader than typical DeFi projects. Investors face risks from oracle manipulation, custodial failures, and legal framework enforcement issues. Fraudulent proof-of-reserve attestations add another layer of concern.

Traditional Finance Players Lead Security Standards

Institutional players are setting higher security benchmarks in the RWA space. Companies like BlackRock and Franklin Templeton demonstrate strong security practices through institutional-grade compliance and custody solutions.

Their approach highlights how robust off-chain legal frameworks can protect on-chain value.

Leading RWA platforms have earned top security ratings by partnering with established audit firms. Ondo Finance ranks highest with a AAA security score, positioning itself as a bridge between institutional products and DeFi. The platform offers tokens backed by US Treasuries and bank deposits.

Gold tokenization projects also show strong security metrics. Paxos operates under New York regulatory oversight, with each token representing one ounce of vaulted gold. These projects provide audited reserves and global liquidity for precious metal exposure.

RWA Market Concentration Creates Systemic Risks

The RWA sector’s growth pattern creates concerning concentration risks. Most tokenized assets reside on a few dominant blockchains, particularly Ethereum. A handful of leading protocols control the majority of market value.

This concentration means the entire RWA ecosystem depends heavily on these key players’ security and operational integrity. Any major incident affecting these platforms could impact the broader market significantly.

Investors should evaluate RWA projects using comprehensive security frameworks that assess both on-chain and off-chain components. The hybrid nature of these assets requires due diligence beyond standard smart contract analysis.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.