In a bold move to stem the Russian ruble’s free fall, President Vladimir Putin has issued a directive compelling select exporters to trade their foreign currency earnings for the domestic currency.

The ruble, which had hit a historic low due to Western sanctions and rising inflation, witnessed a remarkable uptick of over 3% on Thursday, reaching levels not seen since late September. This currency resurgence extended to gains against the euro and the yuan.

The government has declared that these new currency controls will remain in effect for six months, targeting an undisclosed list of exporting companies. These firms are now required to submit their strategies to the central bank and a financial watchdog.

Ruble Down 40% This Year

The ruble has borne the brunt of a daunting depreciation, losing about 40% of its value against the US dollar this year. This sharp decline is a direct result of the economic pressures arising from Russia’s military involvement in Ukraine and its ongoing standoff with Western powers.

To counter these adversities, the US and its allies have enforced several rounds of sanctions on Russia, primarily targeting the energy, banking, and defense sectors. These measures have effectively severed Russia’s access to international financing and substantially depleted its foreign exchange reserves.

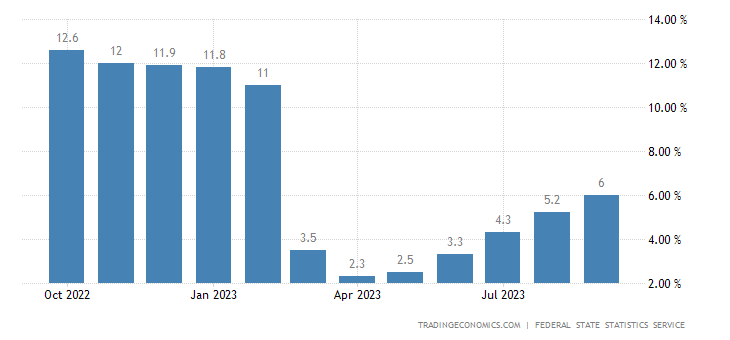

Moreover, the ruble’s plummet has exacerbated inflation, surging to a staggering 6% in September, marking the highest level since before base effects from the Russian invasion of Ukraine ended in February this year.

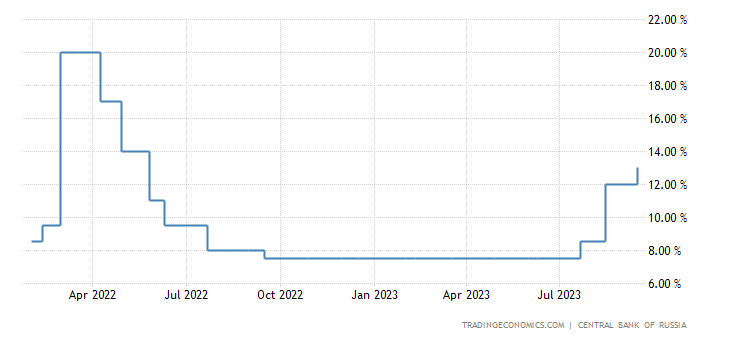

President Putin recently acknowledged the crippling effects of inflation, describing it as “practically impossible” for businesses to make future plans. The central bank resorted to raising interest rates to 13%, but this has failed to stabilize the ruble.

Currency Control Not New for Russia

Currency controls are not entirely new to Russia, as they were previously employed in 2022 following Russia’s full-scale invasion of Ukraine. Back then, they played a pivotal role in rescuing the ruble from an all-time low of 154 per dollar, propelling it to a seven-year high of 50 in mid-2022.

However, some analysts caution that these controls may have a long-term detrimental impact on the Russian economy, discouraging foreign investment and undermining competitiveness.

Try Out Our Trading Bot Services Today. Get Started Here

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.