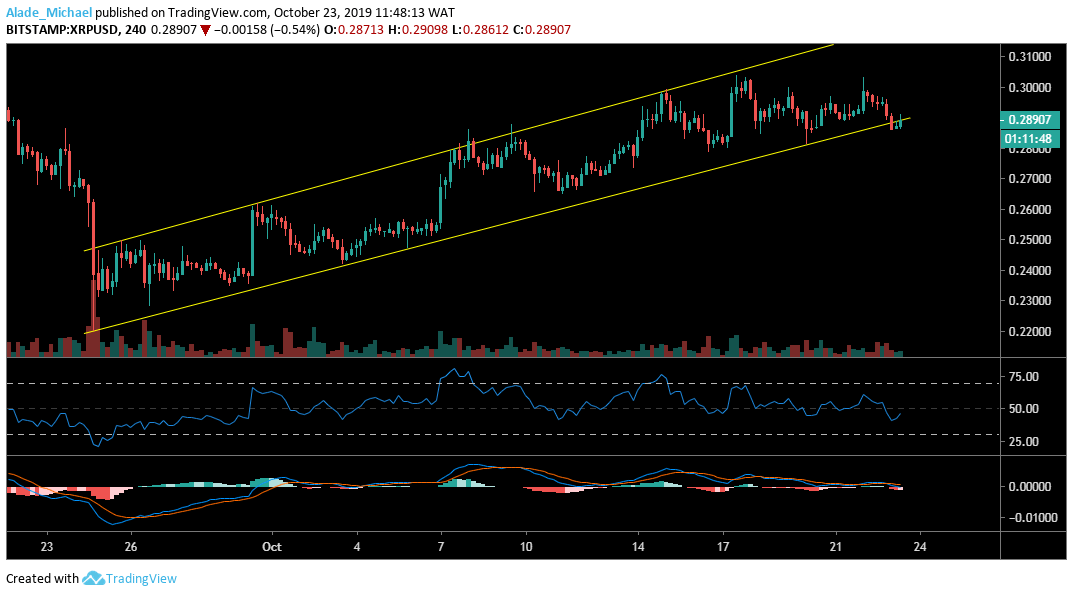

Ripple (XRP) Price Analysis: 4H Chart – Bearish

Key resistance levels: $0.299, $0.32

Key support levels: $0.265, $0.23

On the 4-hour chart, Ripple’s XRP has slightly dropped to the lower boundary of the ascending channel which has been forming since September 24. The recent move could lead to a price break-down if the bears stay long in the market. In case of more selling pressure, XRP may encounter support at $0.265 and $0.23.

As we can see on the price chart, the crypto trading signals a bearish divergence on the technical indicators (RSI and MACD) – which shows that a heavy sell-off is coming up sooner than later. In view of that, the XRP bulls may still manage to push the price to $0.299 and $0.32 on the upside. However, the market is looking bullish at the moment.

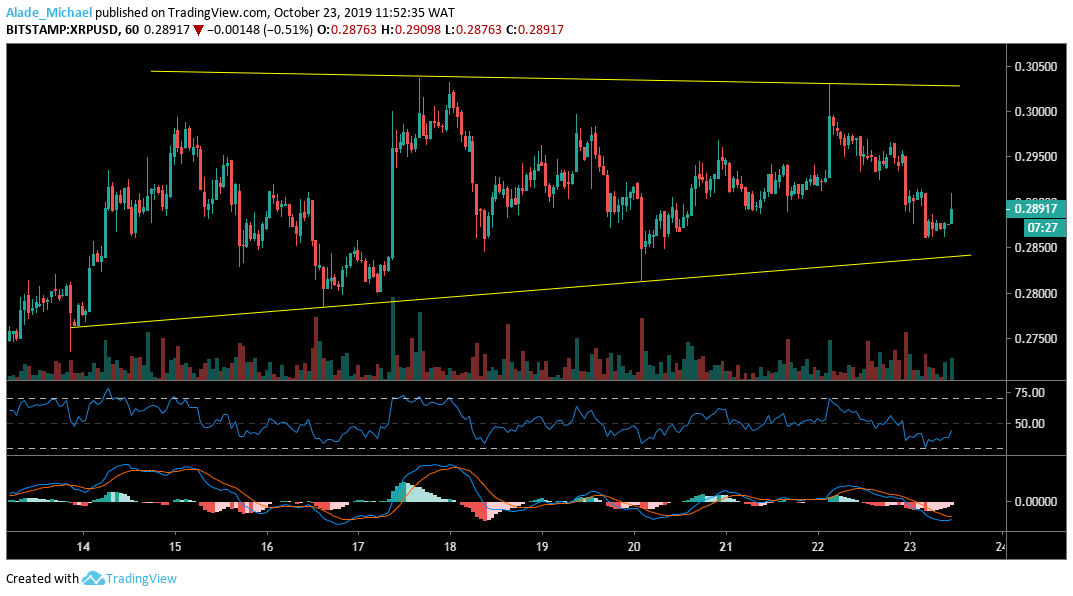

Ripple (XRP) Price Analysis: Hourly Chart – Neutral

Ripple’s XRP is trading in a wedge pattern on the hourly chart. Looking at the market structure, the price is near the wedge’s support at $0.285 – where a bounce off is likely to occur. The important resistance to watch out for now is $0.30. However, we can see that the chart’s volume is also fading.

This corresponds with the recent bearish swing on the technical MACD and RSI indicators, suggesting that the XRP market is currently down amidst a sideways trend. A further low drive may slip the price to $0.275 and $0.265 on the downside. A significant rise above the $0.30 resistance should keep the market in an uptrend. For now, XRP remains neutral on a short-term.

XRP SELL SIGNAL

Sell Entry: $0.289

TP: $0.265

SL: $0.31

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.