Blockchain payments network Ripple has announced a collaboration with Mercado Bitcoin, a major cryptocurrency exchange in Brazil, to launch cross-border payments enabled by crypto technology.

The partnership, revealed on October 3, aims to provide Brazilian businesses with faster and more cost-effective international payment options. Ripple’s “managed end-to-end payments solution” will power the new service, allowing for 24/7 settlement of payments within minutes.

According to Ripple, the first operation will target institutional customers exclusively, focusing on transactions between Mercado Bitcoin in Brazil and its Portuguese counterpart. The integration leverages Ripple’s new functionality introduced in 2023, which allows the firm to manage payments end-to-end on behalf of customers.

A Ripple spokesperson stated that Mercado Bitcoin is expected to implement the payment solution before the end of 2024. The crypto exchange plans to use the technology to enhance its internal treasury operations between Brazil and Portugal initially, with future plans to support cross-border payments for both corporate and retail customers.

Jordan Abud, head of banking at Mercado Bitcoin, emphasized the partnership’s role in simplifying transfers and internationalizing the exchange’s services. “The possibility of facilitating this type of operation, offering lower costs, and making the platform even more complete shows our commitment to customers while expanding the portfolio of products we offer today,” Abud noted.

Mercado Bitcoin, established in 2013, is one of Latin America’s largest crypto exchanges, boasting 4 million users. The company has previously partnered with Mastercard on various initiatives, including a Web3-focused crypto identity system announced in April 2023.

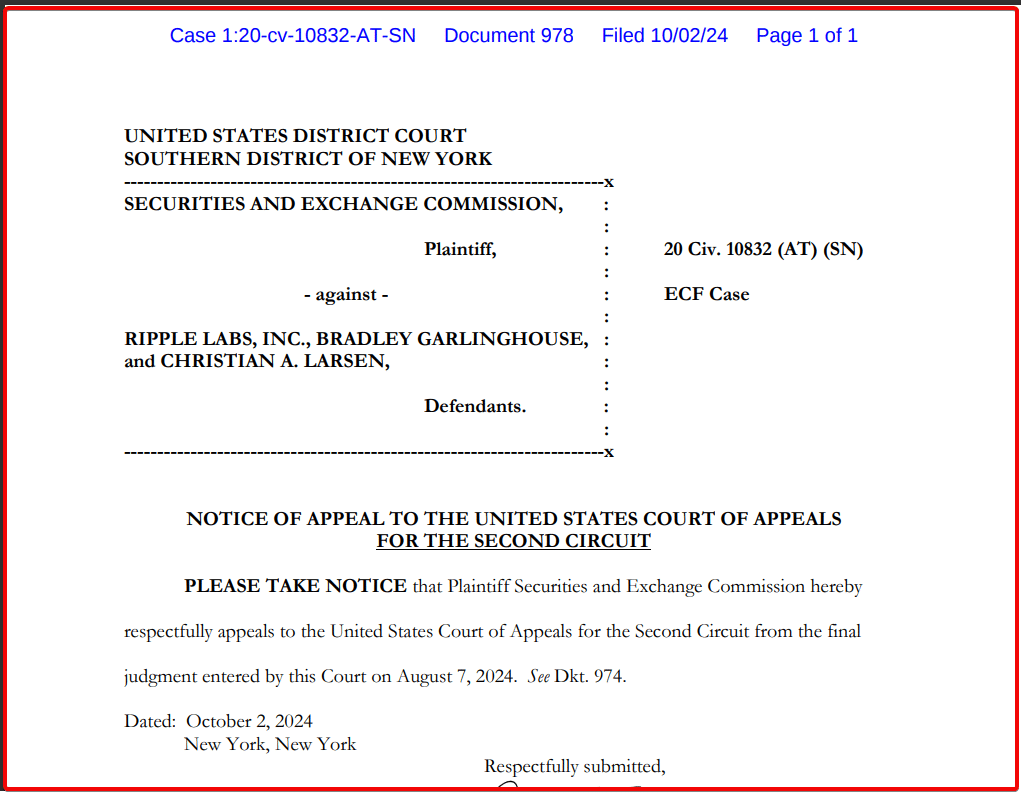

SEC Looking to Reopen Case Against Ripple

This development comes as Ripple faces ongoing legal challenges. On October 2, the U.S. Securities and Exchange Commission (SEC) filed an appeal against a previous court ruling regarding Ripple’s XRP token sales. The SEC maintains that the district court’s decision conflicts with established Supreme Court precedent and securities laws.

Ripple CEO Brad Garlinghouse responded to the appeal on social media, stating, “Ripple, the crypto industry, and the rule of law have already prevailed.” He asserted that XRP’s status as a non-security remains unchanged despite the appeal.

If Gensler and the SEC were rational, they would have moved on from this case long ago. It certainly hasn’t protected investors and instead has damaged the credibility and reputation of the SEC.

Somehow, they still haven’t gotten the message: they lost on everything that… https://t.co/1hW7xVSL9b

— Brad Garlinghouse (@bgarlinghouse) October 2, 2024

As Ripple expands its cross-border payment solutions and navigates legal challenges, the outcome of these developments could have significant implications for the broader cryptocurrency industry and the future of blockchain-based financial services.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.