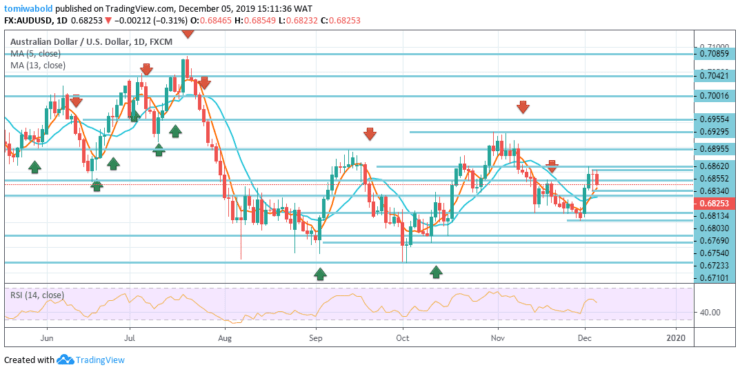

AUDUSD Price Analysis – December 5

AUDUSD has continued to lose ground during the middle of the European session and is currently near its lower daily range, around the 0.6830-25 levels. While increasing the risk of reversal, its weak momentum and reversing the trend from the overbought zone, adds to the negative signals.

Key Levels

Resistance Levels: 0.7205, 0.7085, 0.6955

Support Levels: 0.6813, 0.6754, 0.6670

AUDUSD Long term Trend: Bearish

As we observe the longer-term pattern, with the level at 0.7085 resistance intact, there is no clear-cut confirmation of a trend reversal yet. This means that the downtrend from the level at 0.7205 (high) is still expected to continue to the level at 0.6670 (low).

However, a decisive break of the level at 0.7085 may validate the long-term bottom and bring back a solid advance above the daily moving average 5 and 13 handles towards the next upper horizontal zone (now on the level at 0.7205).

AUDUSD Short term Trend: Ranging

On the flip side, the AUDUSD’s 4-hour bias turned neutral as it retreated from the level at 0.6862. At the moment, the rally stays moderate as long as the level at 0.6754 support stays intact. Above the level at 0.6862 may target the level at 0.6929 resistance first.

A break here may reactivate the recovery from the level at 0.6670 and the overall target is expected from the level at 0.6670 to 0.6929 from 0.6754 at 0.7001. On the downside, a break of the level at 0.6754 may resume the bearish pattern of the level at 0.6929 to retest the level at 0.6670.

Instrument: AUDUSD

Order: Sell

Entry price: 0.6834

Stop: 0.6862

Target: 0.6754

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.