The European session on Wednesday has shown positive momentum for gold, with the Asian equities market climbing higher after it was announced that Moderna’s Coronavirus vaccine had been ‘green-lighted’ after a successful safety trial.

The upbeat tone from the Asian markets and the growing risk appetite could bolster further gains in gold later in today’s European and American sessions.

However, the question on many investors’ lips is; how long can this renewed sentiment be sustained? Given that Q2 earnings are expected to be poor and Coronavirus cases in the US have now passed 3.5 million, things could turn sour in the equity markets and this could have a rippling effect on gold. Nonetheless, the yellow metal is expected to remain bullish above the $1,790 level.

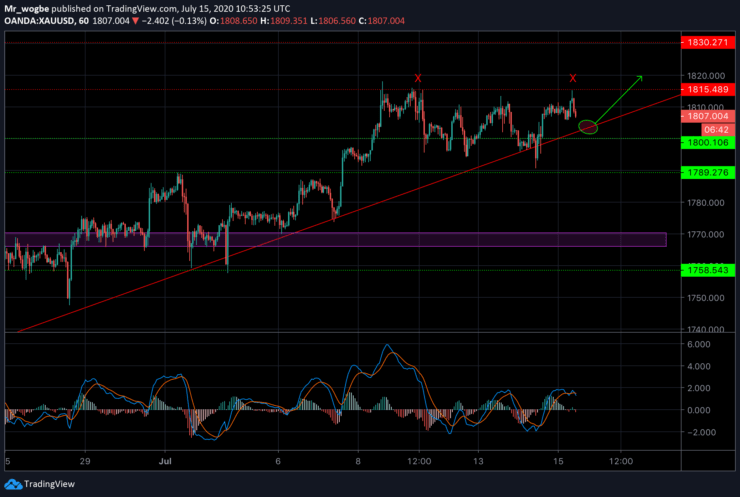

Gold (XAU) Value Forecast — July 15

XAU/USD Major Bias: Bullish

Supply Levels: $1,815, $1,818, and $1,827

Demand Levels: $1,800, $1,790, and $1,780

Gold performed exactly how we projected. We got a bounce off the ascending trendline and hit an all week high of $1,815 (strong resistance) just a few hours ago. At press time, gold is finding its balance at $1,810 as it attempts to hit a fresh high around $1,818-20.

A dip from this point will likely be supported by the $1,803 level, which could send the price soaring above $1,815 in the near-term.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.