Quant Price Forecast: February 7

The Quant price forecast is for the market to rally after it drops to its former resistance level of $125.25.

Quant Long-Term Trend: Bullish (1-Day Chart)

Key Levels:

Zones of supply: $155.70, $227.70

Zones of Demand: $88.70, $101.30

The Quant market is seeking to strengthen at its former consolidation resistance level. The coin has been unable to break through the current resistance level at $155.70 after many tests, and it is now reverting toward the support level, where more bulls are waiting to enter the market at a lower price.

Quant Price Forecast: QNT/USD Outlook

To breach the current supply line, the Quant market has decided to pull back to the underlying support level, which once acted as the resistance level to keep the price in consolidation.

The market is being forced into a pullback due to the strength of the supply zone. Therefore, the retracement will enable the coin to get more bulls on the market to force through the supply level.

As a result, the market has traded to the downside of the Envelope middle line. The price is now approaching the lower line. However, Quant is expected to turn around at $125.25, just before reaching the lower line.

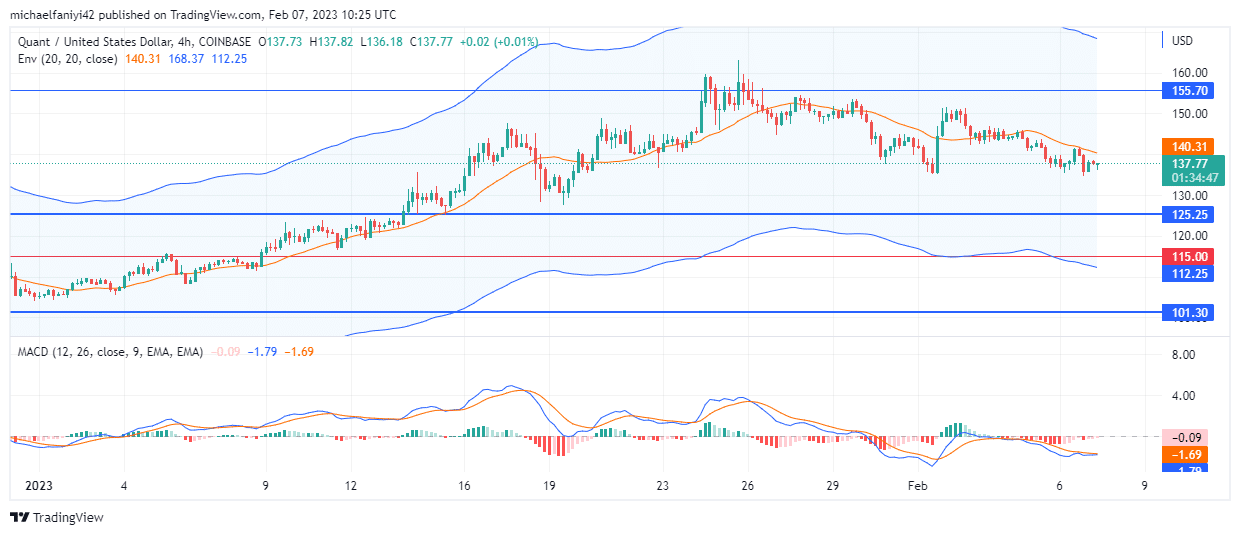

QNT/USD Medium-Term Trend: Bullish (4-hour chart)

Still, on the daily chart, the MACD (Moving Average Convergence Divergence) indicator has its lines crossing downward and taking a long dip toward the zero level. The current histogram bars are all bearish and are increasing in size with each passing day.

On the 4-hour chart, the price is still fluctuating around the middle of the Envelope indicator. Meanwhile, the MACD has officially entered negative territory. As in the previous instance, the rallying level is at the $125.25 demand level, and the price may drop closer to it before the rally begins.

Place winning Quant trades with us. Get QNT here

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.