Quant Price Forecast: February 19

The Quant price forecast is for the market to leverage on the strong support it has to violate the weekly resistance level.

Quant Long-Term Trend: Bullish (1-Day Chart)

Key Levels:

Zones of supply: $155.70, $227.70

Zones of Demand: $101.30, $125.25

The Quant market will likely proceed to a ranging market after it is caught up at the $147.60 supply level. The strong support setup underlying the market is the buyers’ confidence. With this, they can expect to triumph over the consolidation and eventually breakout to the upside of the resistance level.

Quant Price Forecast: QNT/USD Outlook

The Quant market rose strongly to the $155.70 key level after a breakout from consolidation. The price defied all the key levels but couldn’t break the $155.70 resistance.

As a result, the market was forced to reinforce itself at the previous supply level of $125.25. This has played out, but the price has been caught up at $147.60.

With the coin having to drop back to supply again, this will probably lead to another consolidation that will strengthen the coin. Nevertheless, the support remains solid with the lower Bollinger Band underlying it.

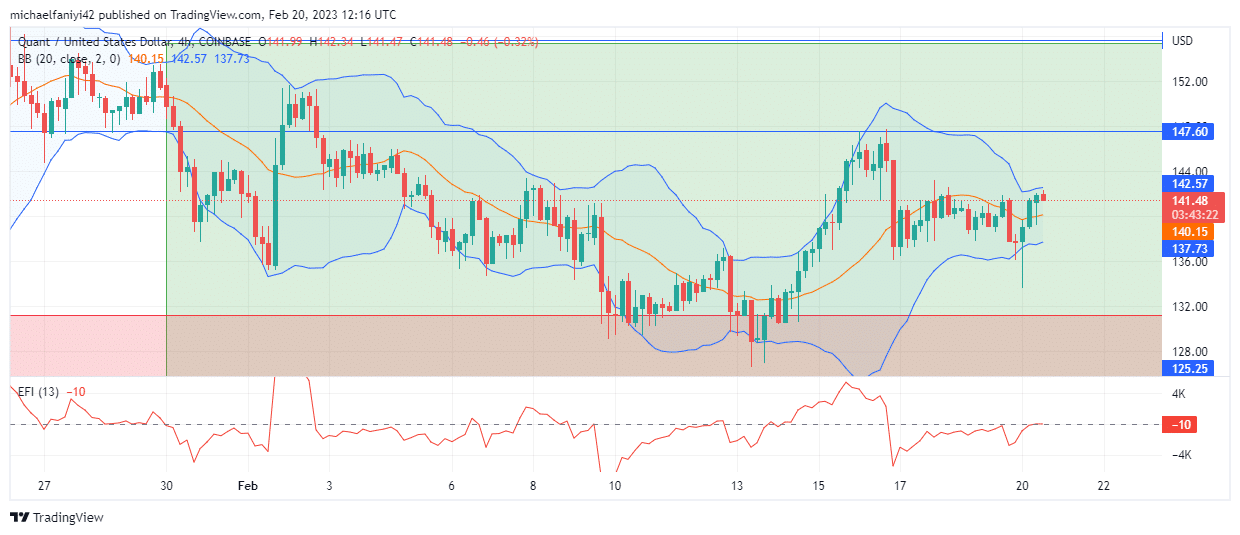

QNT/USD Medium-Term Trend: Bullish (4-hour chart)

The EFI (Elders Force Index) power line has risen above the zero level. This means the buyers have more control over the market although the price has been curtained below the $147.60 price level. Although on the 4-hour chart, the coin dropped immediately after being rejected, it is now attempting to rise again.

The Bollinger Bands on the 4-hour chart have squeezed around the candles. This helps show the movement and direction of the market. With this, the coin is set to drop to the strong support level again as the price is set to gain strength for a breakout through consolidation.

Place winning Quant trades with us. Get QNT here

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.