Quant Price Forecast: January 24

The Quant price forecast is for the market to properly break and stabilize above the $155.70 key level after an initial violation.

Quant Long-Term Trend: Bullish (1-Day Chart)

Key Levels:

Zones of supply: $111.00, $125.25, $227.70

Zones of Demand: $42.40, $88.70, $101.30

Quant has now tested and violated the $155.70 key level. Though the price has dropped below the level, it has caused a weakness in the zone, and the coin is expected to rise again shortly to finally break the level and also stabilize its market above it. This will give QNTUSD a clear target to aim for: the major resistance level at $155.70.

Quant Price Forecast: QNT/USD Outlook

The Quant market has been making genuine progress to the upside ever since its breakout from its consolidation level. The ranging phase has helped the buyers accumulate enough momentum.

It didn’t take too much to breach the $125.25 resistance level. Afterward, the coin rose and returned for a test at $125.25 before pushing harder toward the $155.70 resistance level.

The price has, however, dropped back below $155.70. As shown by the ATR (Average True Range), there has been a remarkable surge in market volatility, which bulls have utilized to breach the $155.70 resistance level.

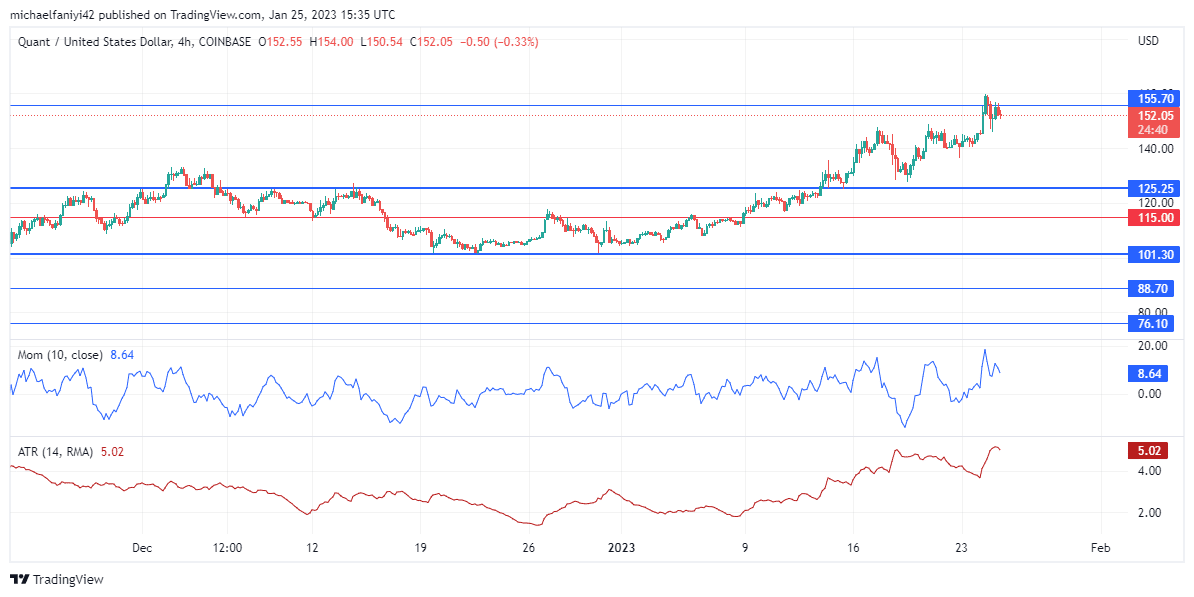

QNT/USD Medium-Term Trend: Bullish (4-hour chart)

It is a bit of a different story concerning the ATR (Average True Range) indicator on the 4-hour chart. It shows that market volatility took a dip immediately as the price began to pull back toward $125.25 for support. The plunge continued steadily even after the price resumed rising. It was after the final surge in price to violate $155.70 that the volatility shot upward again.

Similarly, the market’s momentum has been increasing on the daily chart, even since the coin touched down on the consolidation lower level at $101.30. However, on the 4-hour chart, the momentum trend as shown by the Momentum indicator has been of an undulating sort. Nevertheless, by using every available resource, we expect QNTUSD to finally break and stabilize above $155.70 before aiming for the next level.

Place winning Quant trades with us. Get QNT here

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.