Quant Price Forecast: January 19

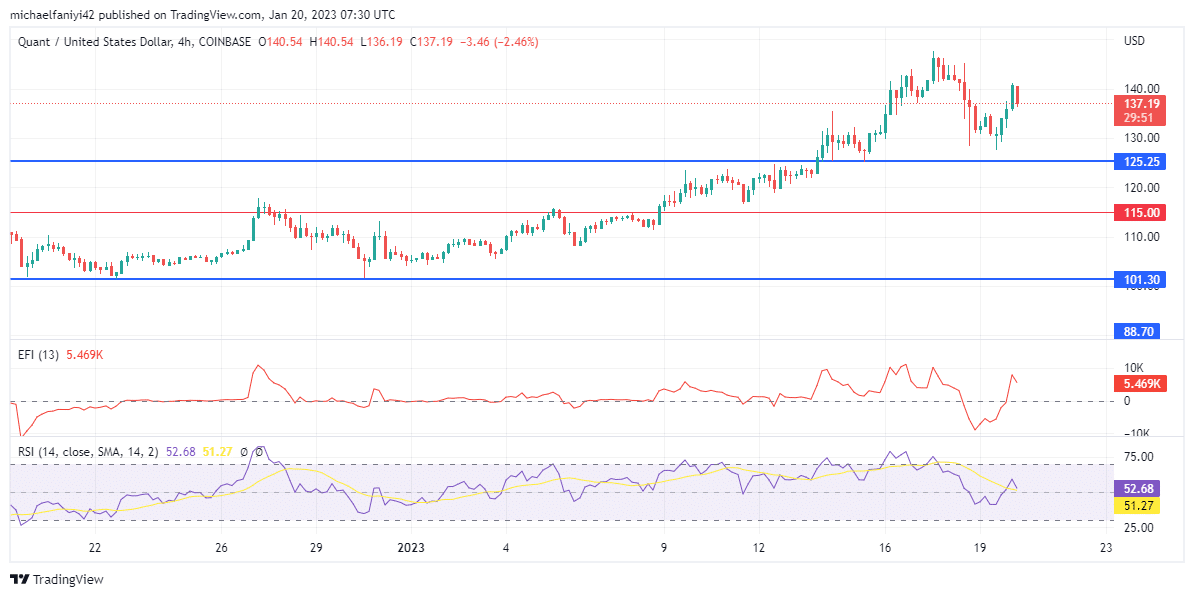

The Quant price forecast is for the coin to push hard for a rally after it bounces off the $125.25 key level.

Quant Long-Term Trend: Bullish (1-Day Chart)

Key Levels:

Zones of supply: $155.70, $227.70

Zones of Demand: $88.70, $101.30

The Quant buyers are very effective. They have continued their display of strength after violating the $125.25 resistance level. Nevertheless, they got weakened midway toward reaching the $155.70 resistance level. The market then pulled back toward the former $125.25 resistance. Only a little touch was needed to set the price rolling back upwards. The sights are now firmly set on $155.70.

Quant Price Forecast: QNT/USD Outlook

Quant recently broke out of the consolidation zone, and it still had enough momentum in the tank to keep pushing higher till it came closer to the next resistance level at $155.70, and by then the buyers became weary.

The buyers then began to seek a revival at the former resistance level of $125.25. A retracement then ensued, and the coin touched down at the key level.

A little touch was enough, and the buyers are now pumped up for the next rally. All the while, despite the retracement in the market, the EFI (Elders Force Index) does not plunge into a negative value, showing the bulls didn’t let go completely.

QNT/USD Medium-Term Trend: Bullish (4-hour chart)

The RSI (Relative Strength Index) on the daily chart drops out of the oversold region but remains in the bullish half of the chart. On the 4-hour chart, the RSI line drops below the 50 mark but recovers immediately above the middle line as the rally begins.

Place winning Quant trades with us. Get QNT here

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.