In anticipation of this week’s UK government budget, the pound (GBP) climbed to its highest level in almost three months against the US dollar (USD) on Tuesday, partly as a result of the tension mounting on the dollar.

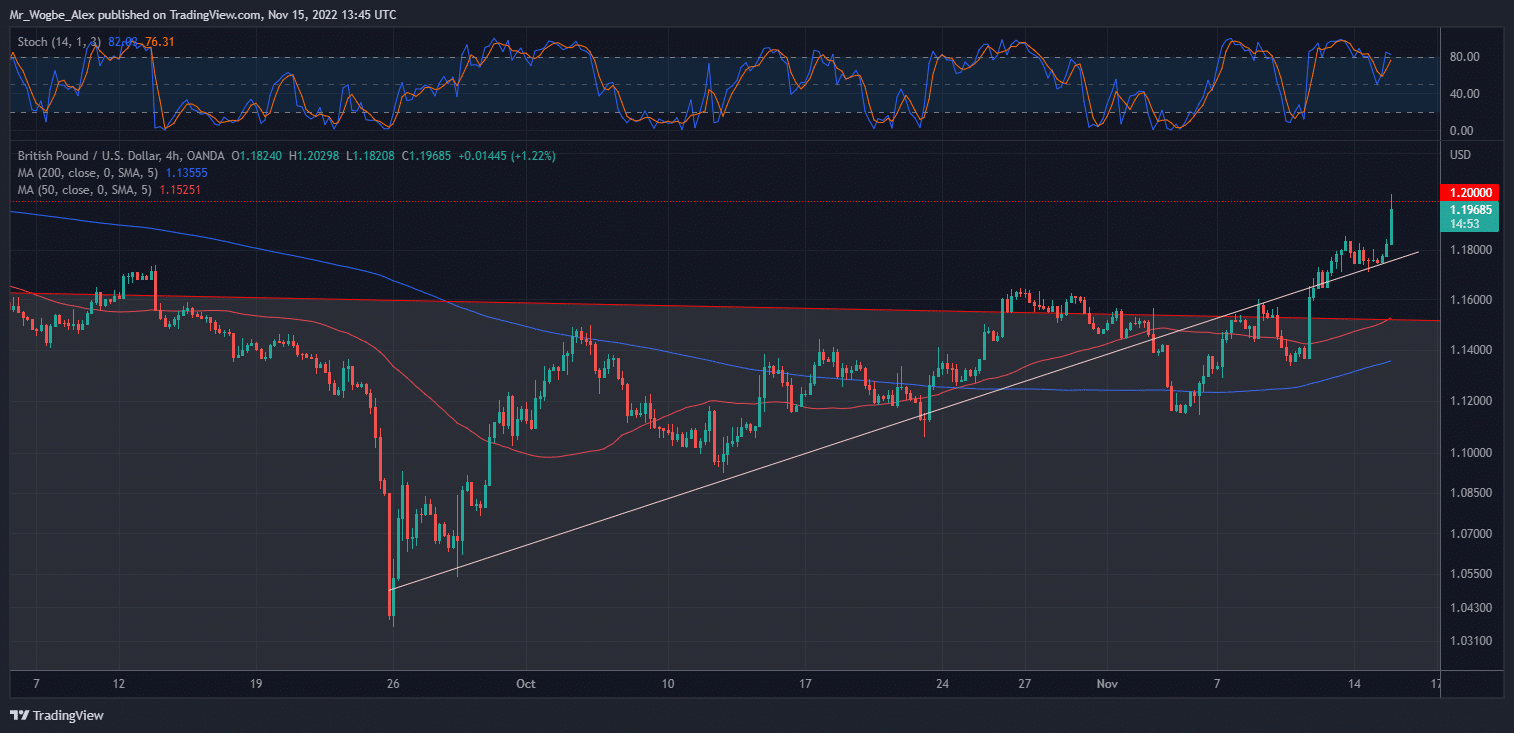

Sterling increased by as much as 2% against the dollar to reach its highest level since late August of 1.2030 as investors evaluated the likely outlook for US interest rates, while the dollar declined against a wide range of other currencies, including the euro (EUR), Australian dollar (AUD), and New Zealand dollar (NZD).

The dollar’s attraction to yield-hungry foreign purchasers is diminished as a result of investors taking into account the likelihood of slower US interest rate increases following last week’s cooler-than-expected reading of US inflation.

Jeremy Hunt, the newly appointed UK finance minister, will present his autumn budget on Thursday. It is anticipated to include a number of initiatives, such as tax increases and spending reductions, that are intended to close a 50 billion pound ($60 billion) funding deficit in Britain’s finances.

Hunt has been eager to convince the markets of the government’s fiscal responsibility, and he and Prime Minister Rishi Sunak are eager to avoid the wave of turbulence that his predecessor, Liz Truss, unleashed with her own budget plan in late September.

At press time, the pound was up 1.9% against the dollar at 1.1970 and up 0.6% versus the euro at 87.26 pence.

Pound on Track for Best Monthly Performance since 2020

With a 4.3% increase so far in November, sterling, which has lost almost 12% of its value versus the dollar this year, is on track to post its biggest monthly gain since July 2020, when the economy started to function again following the first round of pandemic lockdowns.

According to futures markets, there is a 60% possibility that the Bank of England, under the leadership of Governor Andrew Bailey, will boost interest rates by 50 basis points in December and a nearly 40% chance that they will do so by 75 basis points.

According to data released on Tuesday by the Office for National Statistics, the unemployment rate in Britain increased to 3.6% in the three months that ended in September, and job openings decreased for a fifth consecutive month due to companies’ concerns about the future of the economy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.