Polygon may break up $0.70 resistance level

Polygon (MATICUSD) Price Analysis – 06 November

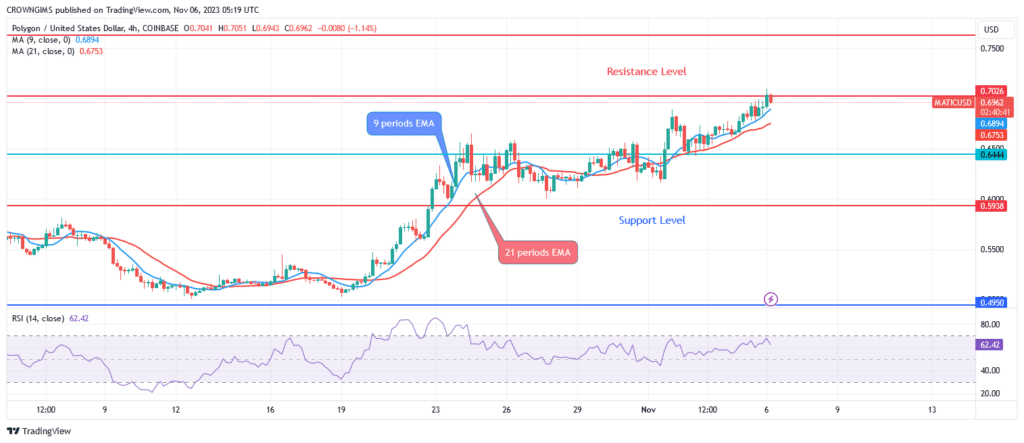

Polygon needs to clear the $0.70 barrier before trying to breach the resistance levels of $0.76 and $0.87. The market has the potential to breach the $0.64 support level and expose itself to the $0.59 and $0.49 levels if sellers manage to build some momentum.

Key Levels:

Resistance levels: $0.70, $0.76, $0.87

Support levels: $0.64, $0.59, $0.49

MATIC/USD Long-term Trend: Bullish

The long-term outlook for MATIC/USD is positive. At $0.49, cryptocurrency found support. It vacillated between $0.49 and $0.59 for more than two weeks. The price fell to a low of the $0.49 barrier level due to the negative momentum, after which the adverse trend began to wane. The support level of $0.49 prevented a further slide while buyers guarded it. Right now, MATIC is moving up above $0.64.

With periods of 9-EMA above 21-EMA and MATIC trading above exponential moving averages is an indication that bulls are dominating the market. Polygon needs to clear the $0.70 barrier before trying to breach the resistance levels of $0.76 and $0.87. The market has the potential to breach the $0.64 support level and expose itself to the $0.59 and $0.49 levels if sellers manage to build some momentum.

MATIC/USD Short-term Trend: Bullish

A polygon’s 4-hour inclination is shown. On the 4 hours, the price action has produced a double bottom chart pattern at $0.49 from the previous week. Retailers don’t seem to be able to lower the price below $0.49. The price is increasing and approaching the $0.70 mark due to buyer demand. The price is currently inclining since sellers and buyers are at odds at the level noted before.

Polygon’s price is currently above both EMAs. The declining 9-period EMA is crossing the ascending 21-day EMA. At level 59, the period 14 signal line of the relative strength index points upward, indicating a buy.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.