DOT has been very bearish since November 2021. The coin formed a peak at $55 before the market set in for a consistent decline in price. The market has dropped by 88% since a significant high was formed in November.

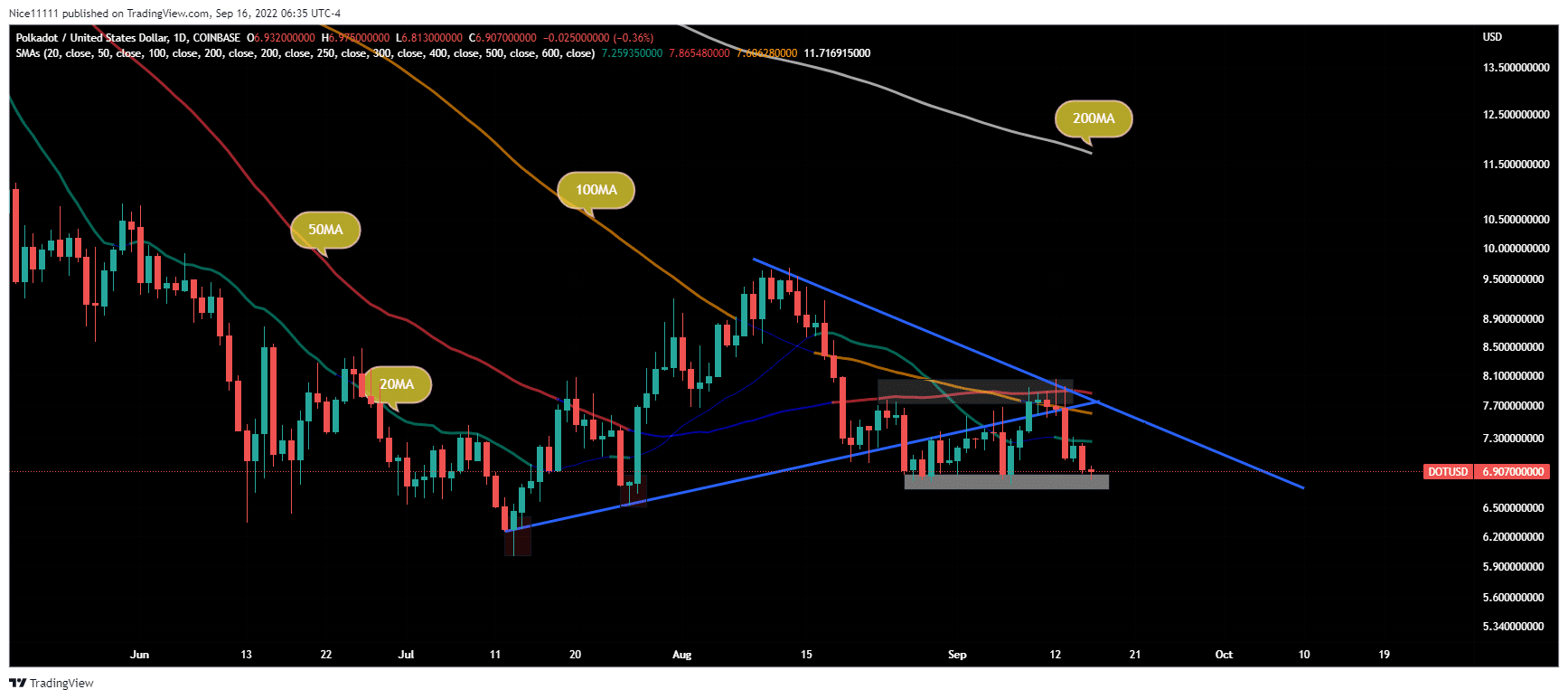

Critical Demand Zones: $6.50 & $6.00

Critical Supply Zones: $8.00 &$ 9.50

MA20: $7.30

MA50: $7.80

MA100: $7.50

MA 200: $11.50

Technical Analysis

The Daily Chart

The months of July and August had a significant move against the overall bearish trend. The price moved from $6.00 in mid-July to $9.50 in mid-August.

The market has fallen by 30% since the high formed in August. DOT has momentarily swerved above the 100 and 50-day moving averages since the year started.

The trend-line that supported the bullish motion during July and August has broken. The price has found a support level at $6.50. The bearish pressure is expected to push through the support level.

Liquidity is resting at a lower price of $6.00. This is likely to be a magnet on price.

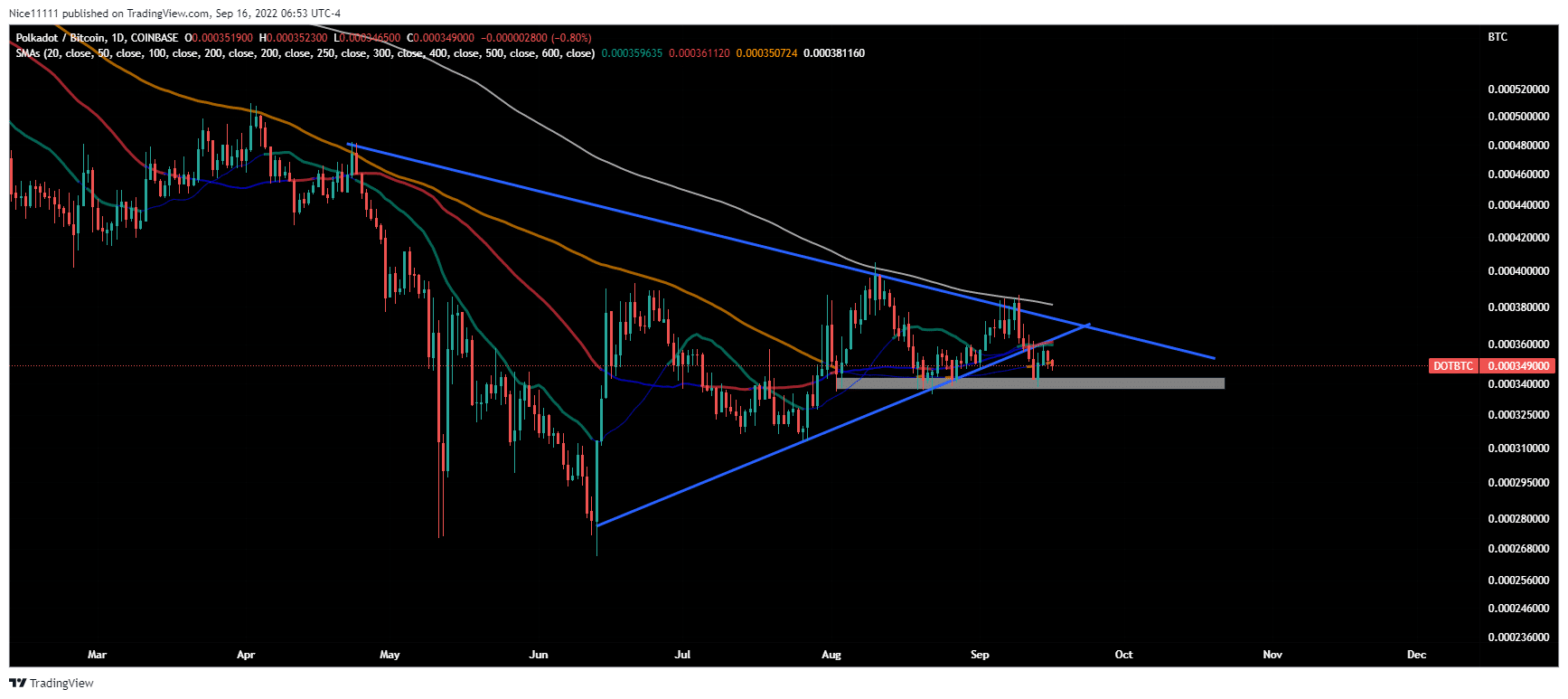

The DOT/BTC Chart

Critical Supply Zones: 0.000480, 0.000400

Critical Demand Zones: 0.000280, 0.000300

The DOT/BTC chart is also bearish, like the DOT/USD. DOT has been ranging after the bearish displacement from 0.000480 to 0.000280.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.