While price action in the Platinum (XPT) market remains elevated, the asset has struggled to convincingly break above the $1,400 mark. This hesitation appears to be linked to an increased supply, as indicated by recent warehouse index data. Nevertheless, the market still shows potential and warrants close monitoring for possible trading opportunities.

Key Price Levels

Resistance: $1,500, $1,550, $1,600

Support: $1,350, $1,300, $1,250

Platinum Pulls Back Toward the $1,390 Threshold

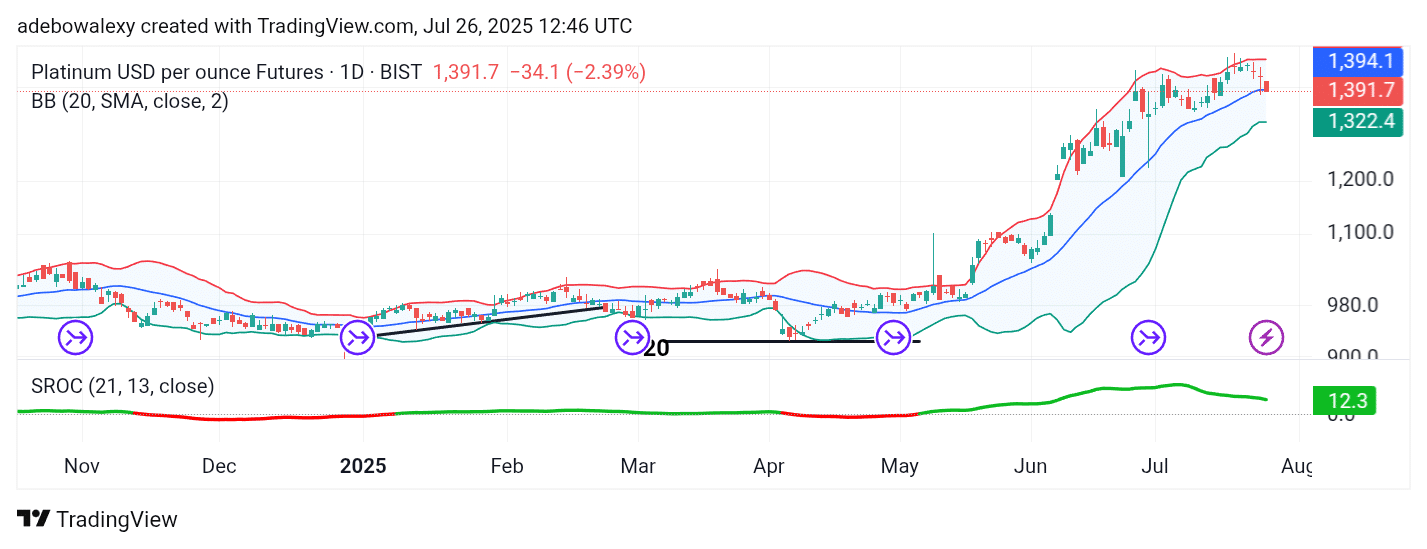

The XPT market recently breached the $1,400 resistance level but faced rejection shortly after testing the upper limit of the Bollinger Bands (BB) indicator. This rejection led to a reversal, driving prices down to the midline of the BB indicator.

A prominent red candlestick currently reflects the decline, with price action now trading just below the middle band. Meanwhile, the Smoothed Rate of Change (SROC) indicator line remains above the equilibrium level, though it is trending slightly downward—indicating weakening bullish momentum and supporting the view of a short-term descent.

XPT Market Holds Above Key Technical Support

On the Platinum 4-hour chart, price action has touched the lower band of the BB indicator. The most recent candle is red but still holds slightly above this lower limit, suggesting that buyers may be attempting to defend the support zone.

The SROC indicator on this timeframe has dipped below the equilibrium level, but it is now moving sideways, potentially signaling the end of the recent bearish momentum. This technical posture implies that bullish forces may be regrouping.

However, upcoming economic data related to Platinum’s demand and supply fundamentals could significantly impact market direction. In the meantime, traders can consider targeting the $1,425 level as a near-term recovery point.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.