The law of demand and supply is once again at play in the platinum market. CFTC Commitment of Traders (COT) data reveal that there are more traders willing to buy than those willing to sell. This imbalance has provided strong support for the market, causing price action to surge past the 1,800 and 1,900 resistance levels.

Key Price Levels

Resistance: 2,000, 2,050, 2,100

Support: 1,950, 1,900, 1,850

Platinum May Witness a Downward Retracement Soon

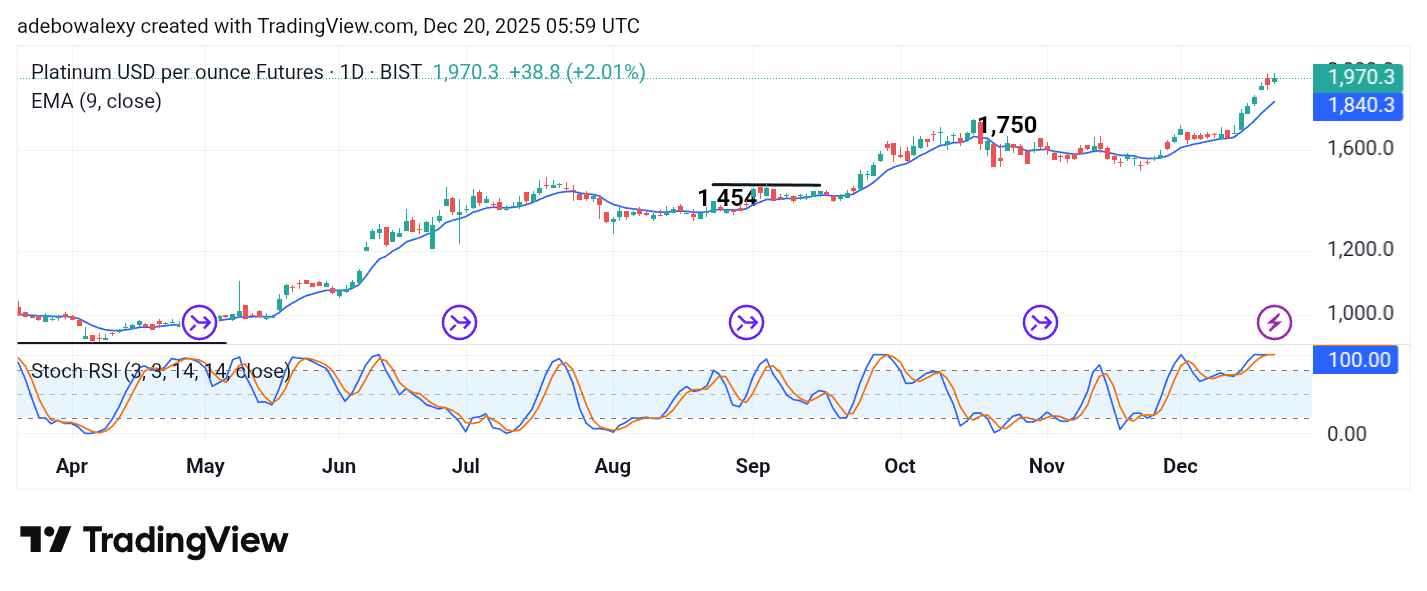

On the daily chart, the XPT market has recorded notable price movement over the past week, pushing the market to a new high. The most recent price candle is bullish and follows a preceding bearish candle.

Notably, both candles are testing resistance around the 2,000 price level, indicating that the market is encountering strong overhead resistance.

Additionally, the Stochastic Relative Strength Index (SRSI) indicator lines are moving sideways at the upper boundary of the indicator, near the 100 level. This suggests that bullish momentum may be nearing exhaustion.

XPT Downward Retracement May Have Started

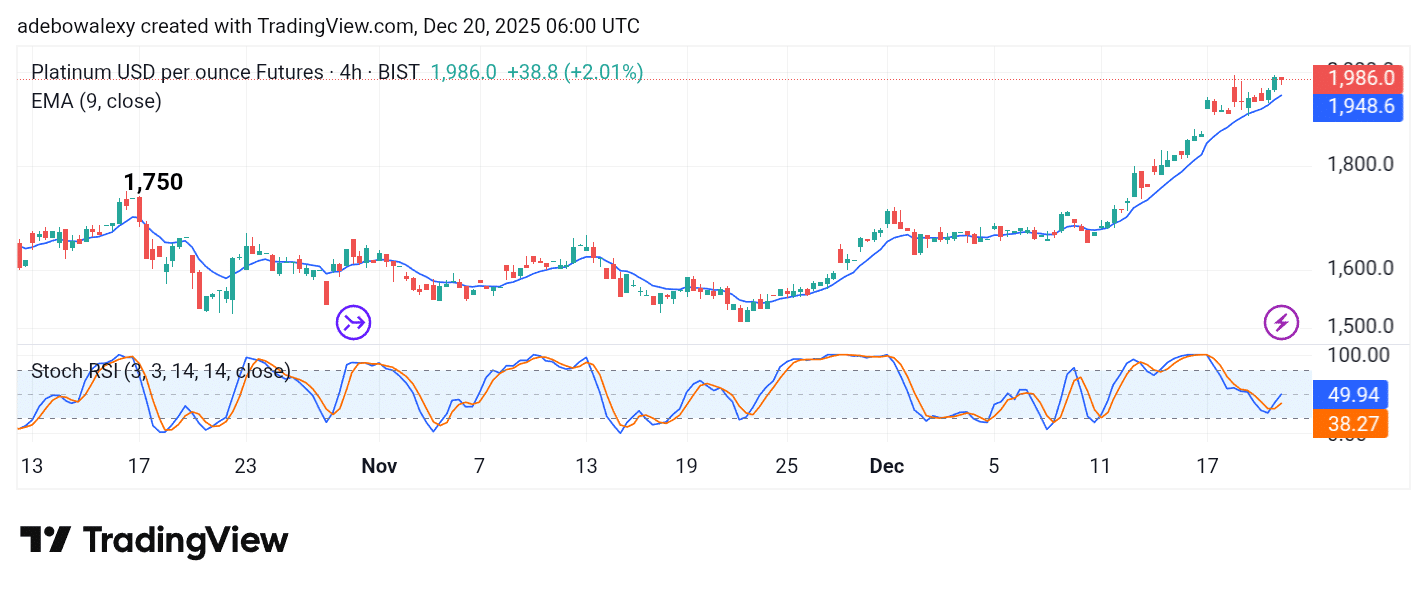

While price action remains above the 9-day Exponential Moving Average (EMA), the current session on the 4-hour chart is printing a red candle. This candle resembles a hammer formation while still standing above the 9-day EMA.

Meanwhile, the SRSI indicator lines maintain a mild upward bias but remain below the 50 level. This indicates that although a short-term pullback may occur, the medium-term outlook still supports a possible attempt to break above the 2,000 psychological level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.