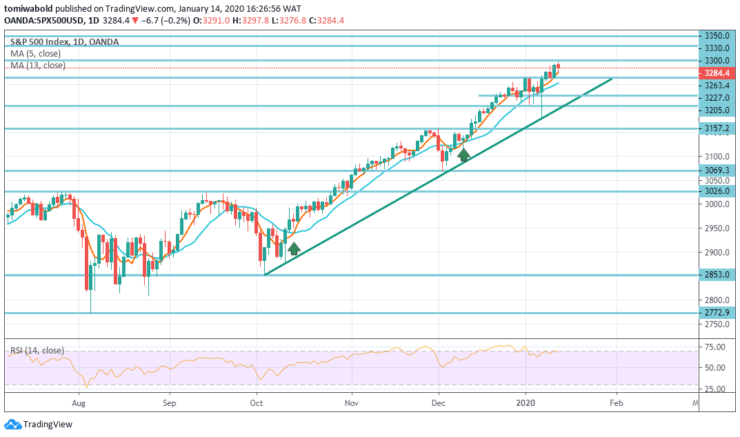

S & P 500 Price Analysis – January 14

On Tuesday, the S & P 500 reached a new all-time high, helped by a decision of the US government to eliminate China’s label as a currency manipulator. The S & P 500 is presently trading at 3,284 in the American session, dropping to a price level of 3276.8.

Key levels

Resistance Levels: 3,350, 3,330, 3,300

Support Levels: 3,263.4, 3,205, 3,157

S & P 500 Long-term trend: Bullish

In the scenario of a long-term forecast, the S & P 500 quite has the potential for continued growth. While from the price model we see that the bias continues to be bullish. S & P closed at the price level of 3,288 in the previous session, only 12 points from 3,300 levels.

The anticipated move past the level at 3300.00 may target the level at 3,330.00 & 3,350.00 in extension. While below the level of 3,263.4, further decline is possible with the levels of 3,227.0 and 3,205.0 as targets.

S&P 500 Short term Trend: Bullish

The recent impulsive structure undergrowth indicates that the S & P 500 is running in an incomplete bullish sequence and yet should reach a new all-time high.

As a result, the main trend in the S & P 500 may stay bullish, while the price continues to move beyond the price level of 3,263.4. Finally, in the event of an unexpected plunge in prices beneath the price level of 3,263.4, we may assume that the bull trend has ended.

Instrument: S&P 500

Order: Buy

Entry price: 3,275

Stop: 3,227

Target: 3,330

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.