Overconfidence sits quietly at the core of many trading failures. It feels like confidence, yet it moves without caution. Traders often believe they see more, know more, and control more than the market allows. However, trading remains a profession governed by uncertainty, discipline, and probability.

The Paradox of Confidence

Overconfidence produces a dangerous paradox. A trader requires belief to participate. Yet, that belief must remain grounded in realistic expectations. Without restraint, confidence evolves into fantasy. I once met a trader who sought a system that traded FX on five-minute charts, required no manual intervention, and promised 20% monthly returns. A simple calculation revealed that $100,000 compounded under those conditions for 10 years would produce $317 trillion. When I highlighted that this reflected nearly the total private wealth of the world, they replied, “So?”

Such thinking shows how overconfidence disconnects individuals from reality. The market does not bend to desire, ambition, or optimism. It bends only to logic, math, and risk control.

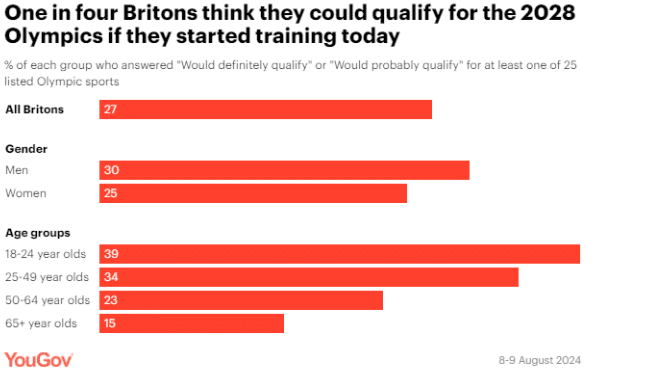

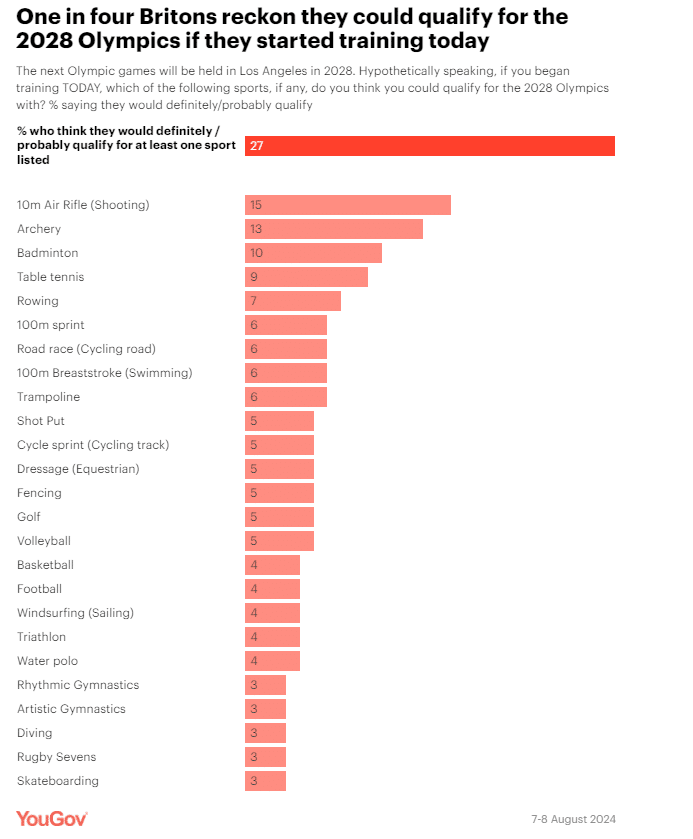

What makes overconfidence more fascinating is its wide application. People are rarely overconfident in only one area. They carry it into many parts of life. Surveys show that 25% of Britons believe they could qualify for the Olympics with training. Even more astonishing, 6% believe they could compete in the 100-meter sprint. Only 190 men have ever run under 10 seconds. Yet many believe they could achieve this in four years.

.

.

Therefore, it is no surprise that traders overestimate their ability to beat global markets. The market does not reward belief. It rewards discipline, patience, and measured execution.

.

.

For context, since 1968 only 190 men have ever run 100 metres in under 10 seconds. That represents roughly 0.000002% of the global population. Yet 6% believe they could compete with athletes who dedicate their lives to shaving milliseconds off a run.

A trader’s true strength lies not in bold confidence but in calibrated confidence supported by data and rules.

In trading, confidence must walk with humility, or it will walk you off a cliff.

Make money without lifting your fingers: Start using a world-class auto trading solution

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.