Optimism represents a significant advancement in Ethereum’s scaling solutions, employing sophisticated layer-2 technology to address the network’s persistent issues of high transaction costs and limited throughput.

This article will explore the intricacies of Optimism’s architecture, its impact on the Ethereum ecosystem, and its position within the competitive landscape of layer-2 solutions.

Technical Foundation of Optimism

At its core, Optimism utilizes “optimistic rollups,” a complex but efficient scaling technique. This method operates by executing transactions off-chain and then posting transaction data to the Ethereum mainnet.

The term “optimistic” stems from the assumption that all transactions are valid unless proven otherwise, which significantly reduces computational overhead.

The process begins with users submitting transactions to Optimism’s layer-2 network. These transactions are then batched together by entities known as sequencers.

The sequencers are responsible for ordering transactions and submitting them as a single, compressed batch to the Ethereum mainnet. This batching process substantially reduces the data footprint on Ethereum, leading to lower gas fees for users.

Optimism’s Evolution and Architectural Improvements

Since its inception, Optimism has undergone significant architectural changes. Initially, it used a system called OVM (Optimistic Virtual Machine), which was a modified version of the Ethereum Virtual Machine (EVM).

However, in its pursuit of greater efficiency and compatibility, Optimism transitioned to OVM 2.0, which is fully EVM-equivalent.

This transition to EVM equivalence was a crucial development. It allowed for seamless deployment of existing Ethereum smart contracts on Optimism without modification, greatly enhancing the platform’s interoperability and developer friendliness.

This compatibility has been a key factor in Optimism’s adoption among various decentralized applications (dApps) and protocols.

Optimism’s Tokenomics and Governance Model

The OP token plays a central role in Optimism’s ecosystem. With a total initial supply of 4.2 billion tokens and a 2% annual inflation rate, OP serves multiple purposes within the network.

Primarily, it functions as a governance token, allowing holders to participate in the platform’s decision-making processes through the Optimism Collective.

Competitive Landscape and Market Position of Optimism

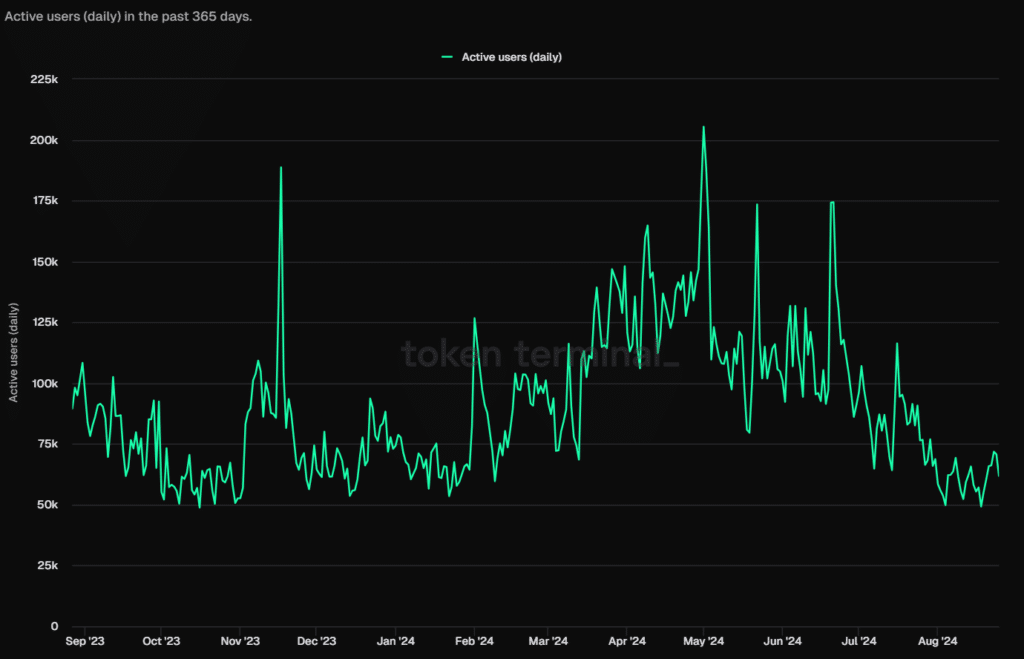

In the rapidly evolving layer-2 ecosystem, Optimism faces stiff competition. While it has shown impressive growth, with daily active users increasing by 50% year-over-year to approximately 90,000, it still trails behind competitors like Arbitrum (476,000 DAU) and Polygon (1.4 million DAU).

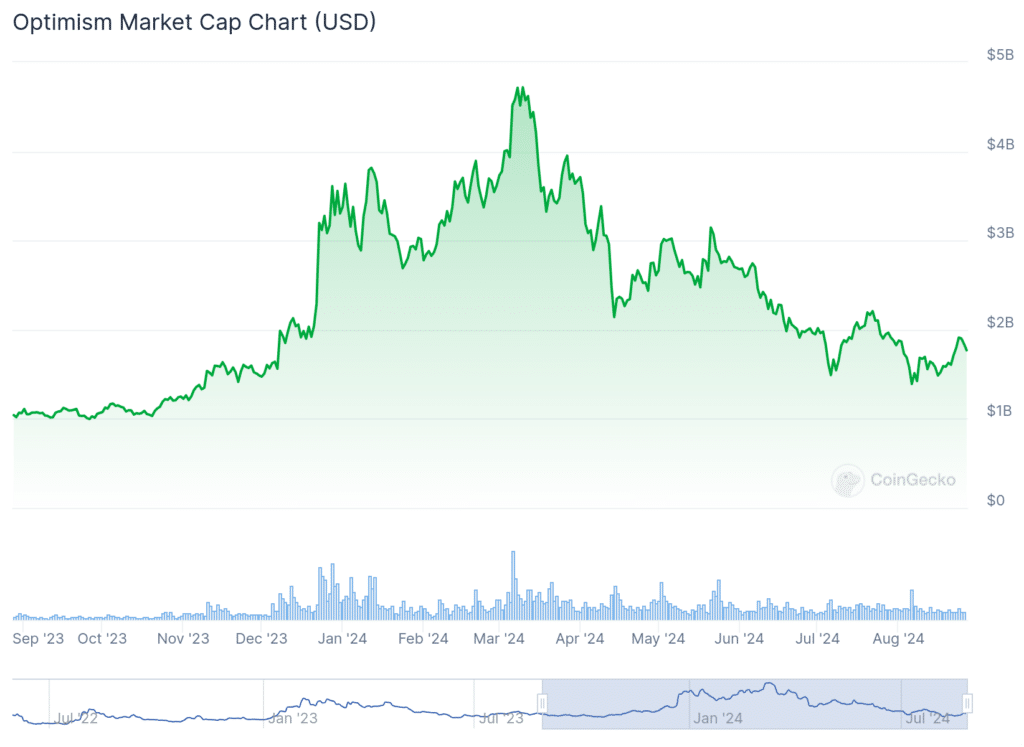

Optimism’s market capitalization of $1.7 billion, while representing a 75% increase from the previous year, also lags behind MATIC (Polygon) at $4.1 billion and ARB (Arbitrum) at $1.8 billion. This market position underscores both the potential for growth and the challenges Optimism faces in a crowded field.

The emergence of newer layer-2 solutions like Base, Blast, and Scroll has further intensified competition. These platforms often leverage different technologies or hybrid approaches, putting pressure on Optimism to continually innovate and differentiate itself.

Technical Challenges and Future Developments

Despite its advancements, Optimism still grapples with technical challenges. One significant issue is the “bridging problem”—the need for users to lock assets in a bridge contract when moving between layer-1 and layer-2. This process introduces additional security risks and complexity.

To address this, Optimism is exploring advanced cryptographic techniques like zero-knowledge proofs. While not currently implemented, the integration of zk-technology could potentially enhance security and reduce withdrawal times, a key bottleneck in current rollup systems.

Another area of focus is improving the decentralization of sequencers. Currently, the sequencing process is more centralized than ideal, which presents both security and philosophical challenges for a system built on blockchain principles.

Optimism’s roadmap includes plans for a more decentralized sequencer network, which would enhance the system’s resilience and align it more closely with Ethereum’s ethos.

The Superchain Vision

Perhaps the most ambitious aspect of Optimism’s future plans is the concept of the “Superchain.” This vision extends beyond simply scaling Ethereum; it aims to create an interconnected network of layer-2 solutions.

The Superchain would allow for seamless interoperability between different rollups, potentially solving the fragmentation issues that currently plague the layer-2 ecosystem.

Rather than competing layer-2 solutions, the Superchain envisions a collaborative ecosystem where different rollups specialize in specific use cases while maintaining interoperability.

If successful, this could dramatically enhance Ethereum’s capacity to handle a diverse range of applications at scale.

Final Word

Optimism represents a sophisticated approach to Ethereum scaling, leveraging advanced technologies like optimistic rollups and EVM-equivalent architecture. Its governance model and tokenomics demonstrate innovative thinking in blockchain economics and community management.

While facing significant competition and technical challenges, Optimism’s growth trajectory and forward-thinking approach position it as a key player in Ethereum’s scaling narrative. The success of its Superchain vision could potentially reshape the layer-2 landscape, making it a project of significant interest for both developers and investors in the Ethereum ecosystem.

Interested In Trading The Market With A Trustworthy Partner? Try LonghornFX Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.